British Chancellor of the Exchequer Rishi Sunak has ordered the Royal Mint to create an NFT to be issued by the summer as part of a wider effort to turn the UK into "a global crypto asset technology hub".

The UK Treasury announced plans to bring Stablecoins -- cryptocurrencies linked to fiat currencies, commodities or other cryptocurrencies -- within regulation in order to make them a recognised form of payment in Britain.

Other measures include legislating for a "financial market infrastructure sandbox" to facilitate innovation in the crypto space and a "CryptoSprint" led by the Financial Conduct Authority seeking views from industry on the development of a future crypto asset regime

The Treasury will also establish a Cryptoasset Engagement Group to work closely with industry on the crypto issues, and it also wants to explore changes to the UK tax system to encourage further development of the crypto asset market.

"It’s my ambition to make the UK a global hub for crypto asset technology, and the measures we’ve outlined today will help to ensure firms can invest, innovate and scale up in this country," Sunak said.

"We want to see the businesses of tomorrow – and the jobs they create - here in the UK, and by regulating effectively we can give them the confidence they need to think and invest long-term.

"This is part of our plan to ensure the UK financial services industry is always at the forefront of technology and innovation."

NFTs or non-fungible tokens are unique digital assets created and stored on the blockchain that are associated with a digital file such as images, songs and videos, although the value of NFTs has proven volatile and the market is reportedly rife with scams.

Advocates of NFTs have touted them as a way of introducing scarcity into the art market and creating collectibles, and leading figures from the worlds of sport and entertainment have adopted the technology and encouraged their followers to invest in personalised collections.

Speaking at the Innovate Finance Global Summit on Monday, Economic Secretary to the UK Treasury John Glen laid out the British government's vision for becoming a global hub for crypto asset technology.

He announced that the UK will explore the benefits of distributed ledger technology (DLT), which allows data to be synchronised and shared in a decentralised manner with the aim of achieving greater efficiency, transparency and resilience, in UK financial markets.

Legislation will be introduced to establish a financial market infrastructure 'sandbox' to allow firms to experiment and innovate in providing the infrastructure services that underpin markets and to test DLT.

The UK government will also initiate a research programme to explore the feasibility and potential benefits of using DLT for sovereign debt instruments, conduct a review into how DeFi loans – where holders of cryptoassets lend them out for a return – are treated for tax purposes; and consult on extending the scope of its Investment Manager Exemption to include cryptoassets.

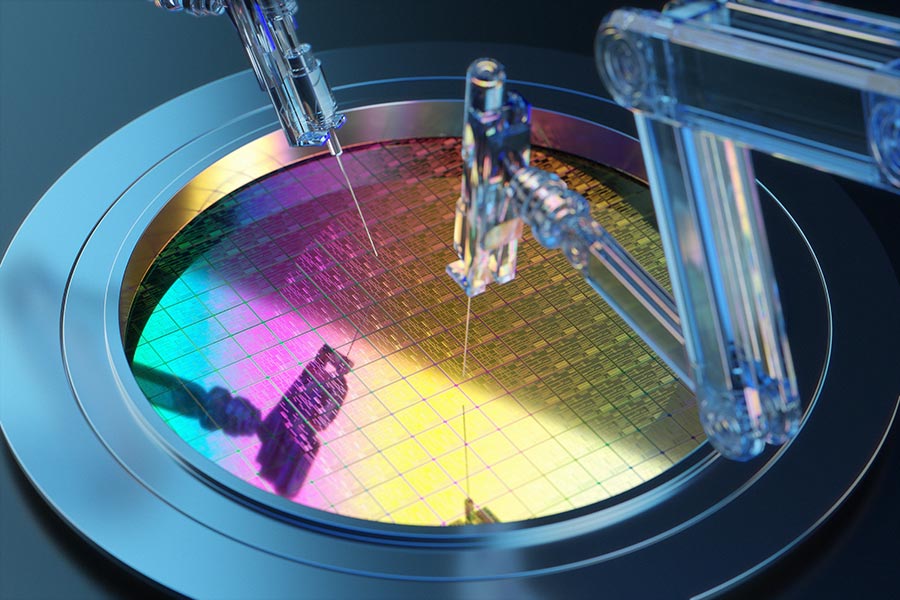

(Pic: Getty Images/Getty Images)