A report on the Irish living sector from real estate agent Cushman & Wakefield shows that the sector performed well in the first half of 2022, with institutional investment stable compared with 2021.

The report covers the private rented sector, social housing, student accommodation, nursing homes and retirement communities.

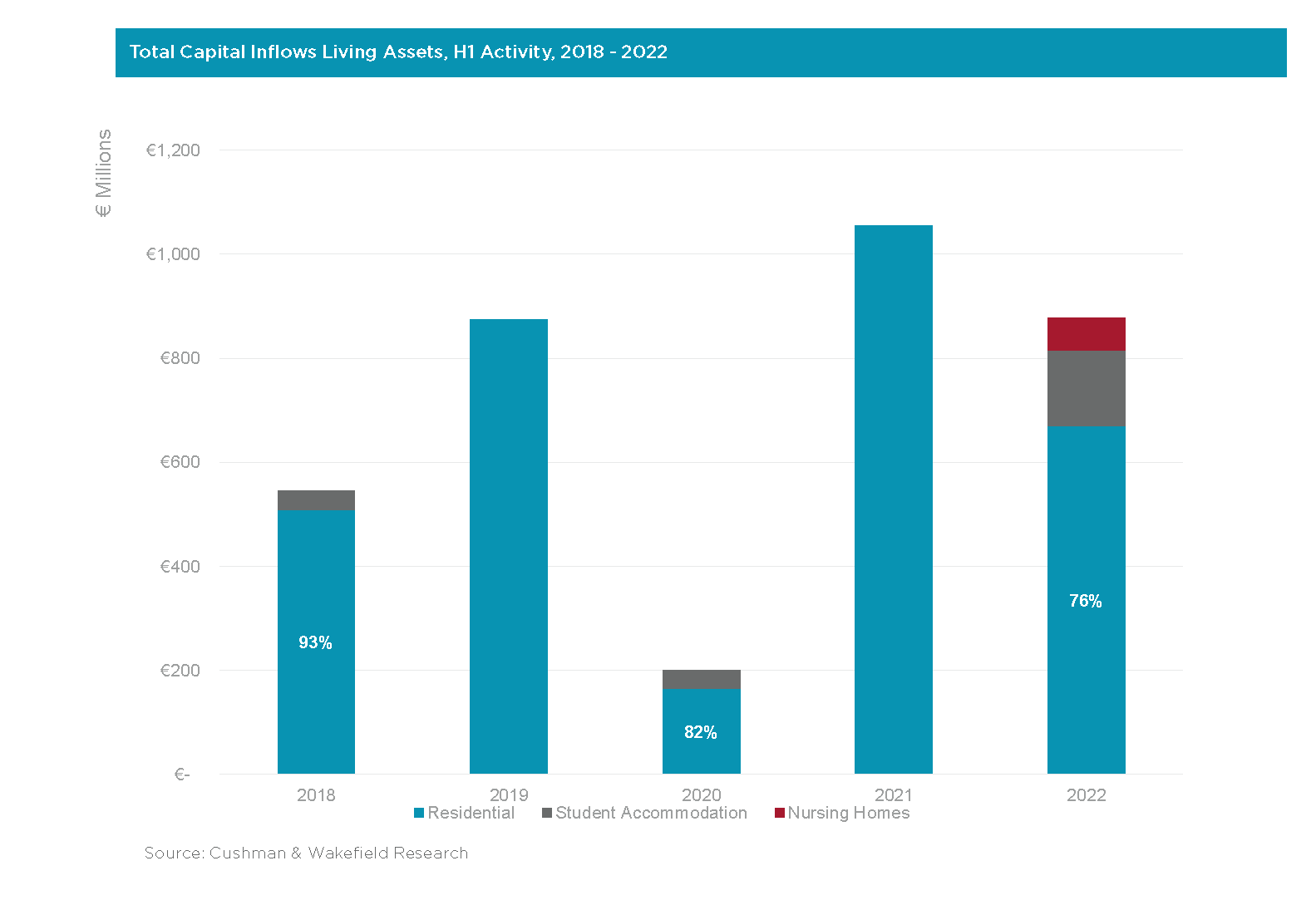

Second quarter investment has been tallied at €500m, with total living investment for the first half of 2022 of €880m, a marginal decrease from 2021.

The largest single transaction was the Project Ruby portfolio, consisting of 664 units in Dublin and Galway, bought by Ares Management Corporation and Generation Partners for €145m.

Cushman & Wakefield says that the Irish market is still attractive for foreign investors as Ireland continues to offer competitive returns compared with other European countries.

Foreign capital accounted for two-thirds of investment in the Living sector in the first half of 2022.

Residential units accounted for 76% of turnover in the market, student accommodation for 17% and nursing homes for 7%.

Cushman & Wakefield chief economist Kate English commented: ‘’Demand is still vastly outstripping supply across the market, including residential property, rental properties, student accommodation and nursing homes.

“The second half of the year is likely to see the external concerns play a bigger role on the market. There will be some level of yield adjustment due to the rising cost of debt, but at this point the adjustment is expected to be small."

English added that there is anecdotal evidence suggesting that construction costs are easing.

She noted that 80% of investment activity in the living sector is forward commit style transactions, with 20% generating income at the point of sale.

“Due to this, in the short term investors may want more scrutiny of costs, contractors, timelines to completion and fixed price contracts in order to progress with transactions,” she explained.

“This will lead to a slower second half of activity in 2022. Despite this, there is still a significant volume of investors seeking a foothold in Irish property.’’

Photo: Kate English, Cushman & Wakefield