Venture capital investment into Irish tech firms in the first half of the year rose by 21% to a record €780m, according to the Irish Venture Capital Association VenturePulse survey published in association with William Fry.

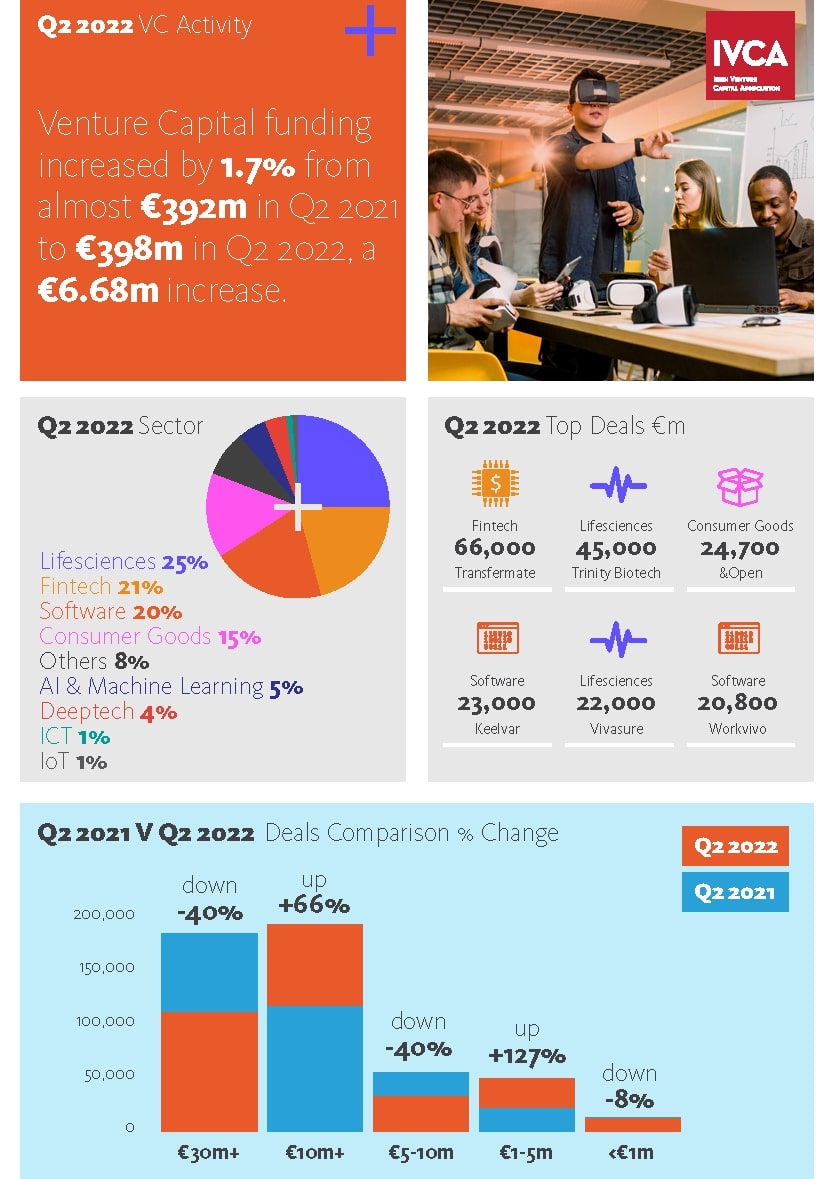

However, this was largely due to a stellar first quarter when funding reached €380m. Funding in the second quarter rose by under 2% year-on-year to €400m.

“It was a strong first half overall for Irish tech companies raising funds, especially when one considers the geopolitical and economic headwinds and downturn in publicly quoted technology stocks over this time,” said Leo Hamill, IVCA chairman.

“It remains to be seen whether the significant slowdown in growth in the second quarter to under 2% heralds a more difficult second half to the year.”

Hamill also highlighted a 50% fall in funding from overseas investors which fell in Q2 to €150m from €300m the previous year.

“This over reliance on foreign investment threatens Ireland’s ability to continue to develop indigenous world class technology companies,” Hamill added.

“The tide of available global capital is starting to go out, which highlights the importance of our pre-budget submission recommending measures to boost domestic sources of funding.”

Seed funding, which represents early stage first round investments, fell by 7% to €47m in H1.

Sarah-Jane Larkin, director general, Irish Venture Capital Association, said that there had been a recovery in the second quarter although she cautioned that it was from a low base.

Seed funding in Q2 rose by 77% to €25m from €14m a year earlier.

“We are optimistic that this upturn in important seed funding will continue as the government’s €90 million fund for Irish start-ups comes on stream in the second half,” Larkin stated.

Funding deals under €1m fell by 19% in H1 to €21m.

Transactions in the €1-5m category dropped by 9% to €84m while deals in the €5-10m range fell by 43% to €44m.

The overall growth for the half year was due to an increase in deals in the €10-30m range which grew by 50% to €260m, and in the over €30m range which increased by 36% to €370m.

“Based on deal sizes, it’s quite hard to analyse what’s going on in the market until we see the results from the next two quarters,” Larkin said.

“If the larger deals fail to come through in the second half, then we could start to see a downturn overall. But while large deals are important, it’s vital that early stage firms and those looking to raise under €5m can source funding.”

Download venture capital recipients listing Q2 2022

Fintech led the way in the first half of the year raising 29% of the total, followed by software (24%) and life sciences (17%).

The VenturePulse survey data covers equity funds raised by Irish SMEs and other SMEs headquartered on the island of Ireland from a wide variety of investors.

This research is the result of information supplied internally by members of the Irish Venture Capital Association and from published information where IVCA members were not involved.

Photo: Leo Hamill, IVCA. (Pic: Chris Bellew / Fennell)