UK Chancellor of the Exchequer Kwasi Kwarteng made a major statement of intent last week when he scrapped Britain's top tax band for people earning over £150,000, but Paschal Donohoe announced no such dramatic measures in Budget 2023.

The most notable change is a €3,200 increase in the earnings threshold for the 20% rate of income tax, meaning single workers will earn €40,000 before becoming subject to the higher rate of 40%, with proportionate increases for married couples and civil partners.

The decision comes a year after Donohoe raised the income band for the 40% rate by €1,500 to start at €36,800, and it is expected to save in the region of €500 per year for those earning €50,000.

The announcement was part of an income tax package valued at €1.1bn, with €50bn in tax having been collected this year to August and expectations of a €1bn general government surplus in 2020.

The package includes €75 increases in the main personal, employee and earned income credits, and a €100 increases in the home carer tax credit.

The second 2% USC band has been raised from €21,295 to €22,920 to ensure people paid the minimum wage remain outside the top rates of USC when it increases 50 cent or 7.6% to €11.30 in January.

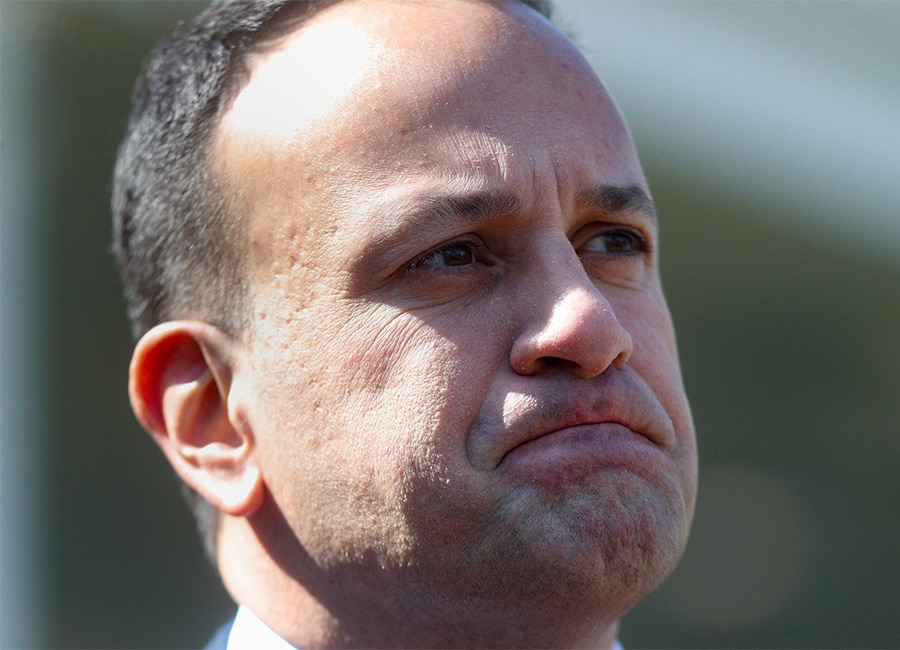

Tánaiste Leo Varadkar's months-long campaign for the creation of a 30% tax band has proven unsuccessful following analysis by the Tax Strategy Group, but Donohoe left the door open for its introduction in next year's budget.

The finance minister said that the move to create a 30% income tax rate in 2023 would require too much time and planning, but that it could be ready to be implemented in January 2024.

"Were the government to opt for the introduction of a third rate of income tax, it would require considerable change to the systems in both the Revenue Commissioners and payroll providers; changes that will need significant lead-time to implement," Donohoe said.

"We are advised that this could be done for January 2024. As a result, my department will engage with the Revenue Commissioners on the necessary preparatory work, in advance of a policy decision being made by government.

The idea of a 30% tax rate was somewhat popular with the public, according to a survey by Taxback.com, with 50% supporting it, though 40% said they had no idea what it would mean.

Ending the segment of his budget speech on income tax, Donohoe said the government is committed to "developing a medium-term roadmap for personal tax reform," taking account of the recent Report of the Commission on Taxation and Welfare.

This roadmap would also consider a range of measures across income tax, USC and PRSI together with other related personal taxation issues.

(Pic: Getty Images/Getty Images)