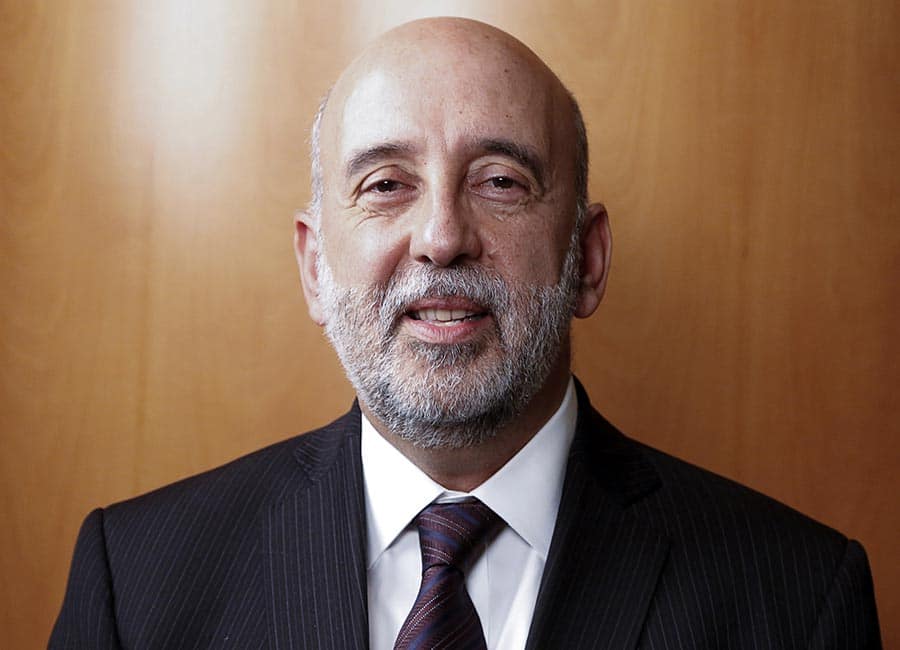

The current phase of rising interest rates is not going to end any time soon, Central Bank Governor Gabriel Makhlouf warned yesterday.

Last month, the European Central Bank announced its third interest rate hike this year, raising the base rate by 0.75% to 2%.

That potentially adds thousands to mortgage-holders' annual repayments if Irish banks pass the charges on to customers.

However, the ECB is expected to announce more increases in the coming months, with at least one more expected before the end of the year.

Mr Makhlouf said: "It's not going to end any time soon, but it will end, and the important thing is that we get on top of inflation.

"The reason interest rates are going up is because inflation needs to be brought down. The ECB's target is 2% over the medium term. We are clearly some way from that.

"If we don't bring inflation under control, the medium-term problems for us will be much worse and there is really no choice but to get to price stability as soon as we can."

Eurozone inflation surged to a record high of 10.7% in October, keeping the pressure on the ECB to continue raising interest rates despite a sharp slowdown in economic growth.

Inflation in Ireland is at 8.2% - its highest since the early 1980s.

The increase in prices across the eurozone accelerated from 9.9% in September, which was already the highest in the 23-year history of the single currency.

The latest eurozone high also outstripped the 10.2% expected in a poll of economists. It was the 12th consecutive month in which inflation set a record high in the eurozone, taking it to more than five times the ECB's 2% target.

Interest rates campaigner David Hall of the Irish Mortgage Holders Organisation said it was better to tackle inflation now before it spirals higher.

Mr Makhlouf was speaking to reporters at a financial system conference in Dublin yesterday.

He also said that more needs to be done to help customers of KBC and Ulster Bank, which are leaving the Irish market, and could even delay their departure until all affected customers have moved their accounts to the remaining banks.

"The banks who are leaving the market, the banks who are inheriting the customers, or likely to inherit the customers, and the community as a whole needs to be doing more to make sure this happens in a smooth way.

"We would expect a better level of service for customers switching," he added.

Opening yesterday's conference, Mr Makhlouf called for greater regulation of the non-bank sector - which includes investment funds, money market funds and special purpose entities.

"The Central Bank of Ireland is planning to introduce leverage limits for property funds connected to the domestic economy, but we cannot tackle the wider issue alone," the Central Bank boss said. "Global and European coordination is needed here, and, I suggest, urgently."