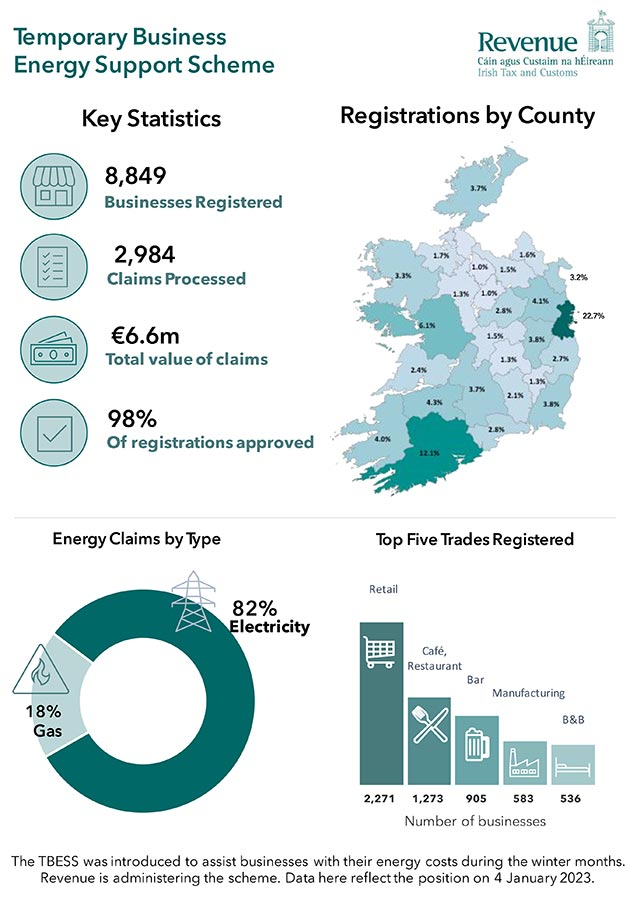

Nearly 9,000 businesses have registered for the Temporary Business Energy Support Scheme, and 3,000 firms have fully completed the claims process, according to a Revenue Commissioners update.

TBESS was introduced in Finance Act 2022 to support qualifying businesses with increases in their electricity or natural gas costs. The scheme, which is being administered by Revenue, provides for a cash payment to qualifying businesses.

A business can make a claim under the scheme if it is tax compliant, carries on a Case I trade or Case II profession, and experienced a significant increase of 50% or more in its electricity and/or natural gas average unit price.

Certain approved sporting bodies and charities are also eligible under particular conditions.

The TBESS operates in respect of energy costs for the period 1 September 2022 to 28 February 2023.

Claims may be made in respect of each calendar month (referred to as a ‘claim period’) within this time frame. Revenue’s online system for registration opened on 26 November 2022 and claims could be submitted under the scheme since 5 December 2022.

Finance Act 2022 was signed into law on 15 December and payments to qualifying claimants commenced after this date.

The Revenue bulletin stated that while 1,172 companies have partially completed the claims process, the claim cannot be processed until the claims process is fully complete.

To date Revenue has paid out only €5.9m in subsidy payments relating to 2,980 claims, an average of €2,000 per claim.

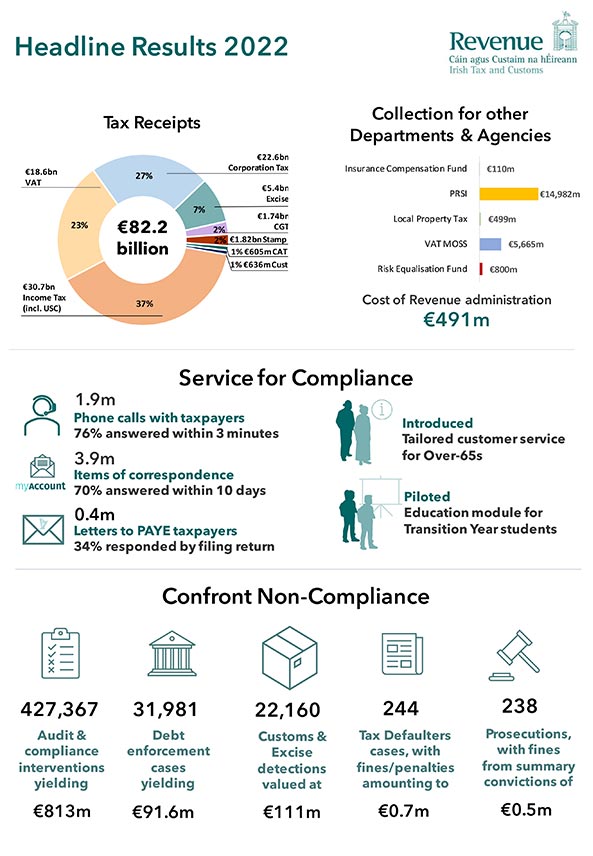

In its preliminary results for 2022, Revenue noted that 2022 saw record breaking tax receipts, with Revenue collecting €82.2bn in taxes and duties for the Exchequer, an increase of some €14.7bn or 21.5% on 2021. In addition, Revenue collected over €22bn on behalf of other departments, agencies and EU member states.

Revenue chairman Niall Cody said the tax collection agency launched a new Compliance Intervention Framework in 2022.

He said that in 2022 Revenue completed 427,000 audit and compliance interventions which yielded €813m. Revenue also secured nine criminal convictions for serious tax evasion and fraud, published 53 tax settlements in the List of Tax Defaulters, and settled 104 tax avoidance cases yielding €16m.

“The identification, targeting and disruption of shadow economy and other illegal activity continues to be a key focus for Revenue,” Cody stated. “In 2022 we seized over 51 million cigarettes valued at €39m and over 3,600 kilos of drugs with an estimated value of €46m.”

Cody added that over the lifetime of the pandemic wage subsidy schemes and the Covid Restrictions Support Scheme, Revenue paid out €10.2bn to support businesses, employers and employees.

Cody described the extension to the Debt Warehousing Scheme announced in October 2022 as “significant”.

He explained: “Businesses with warehoused debt were due to enter into arrangements with us to deal with that debt by the end of 2022, or by 1 May 2023 for those with an extended deadline We extended that timeline to 1 May 2024.

“Coupled with the ongoing availability of the reduced rate of interest of 3%, the extension provides greater certainty for businesses by giving additional time before the warehoused debt needs to be addressed. At present, almost 72,000 businesses are availing of the scheme in respect of some €2.5bn of tax debt.”

Cody stressed that businesses, taxpayers and tax practitioners should always be mindful of the importance of making sure that tax returns and payments are made on time.

“That importance is underlined by the requirement for tax compliance by businesses that want to avail of State support schemes, including the TBESS,” Cody added.

“Continued eligibility for the debt warehouse is dependent on current returns and payments being up to date. This requirement ensures that businesses who are tax compliant are not at a disadvantage to those who are not.

“Following the suspension of general debt enforcement during the pandemic, we resumed normal debt enforcement activities in 2022, including referral to the Sheriff, enforcement through the courts process and attachment.

“We understand that businesses can have temporary cashflow difficulties. In those circumstances, the important thing is to file the required tax returns and engage with us early. We have a proven record of engaging successfully with viable businesses who have temporary cash flow difficulties,” Cody stated

Director-General of customs Gerry Harrahill referenced the impact of the UK’s exit from the EU on 1 January 2021.

“Where online purchases originate from outside the EU, their import is subject to customs formalities, and this is also reflected in the increase in customs declarations. Revenue processed 40 million customs declarations in 2022, an increase of 58% on 2021 declarations,” he disclosed.

Customs duty collected in the year was €640m, up 21% on the previous year. Of the customs duty collected, €280m was in in respect of imports from the UK.

Image: Revenue chairman Niall Cody, Rollingnews