Singapore's sovereign wealth fund GIC is to acquire up to a 16% stake in Eir, purchasing up to €230 million of the group's shares, at a price of €232 per share. The Irish telco said that the deal will be arranged "such that shareholders with smaller percentage holdings will be given the opportunity to participate in the sale so as to facilitate a liquidity event for those holders".

The deal will leave Anchorage Capital Group as Eir's largest shareholder, holding 35% of the group's shares.

GIC is the sovereign wealth fund of the Singaporean Government, led by prime minister Lee Hsien Loong (pictured). The fund was estabished in 1981 to manage Sinagpore's foreign reserves. Along with Temasek Holdings, it is the main sovereign wealth fund owned by the state.

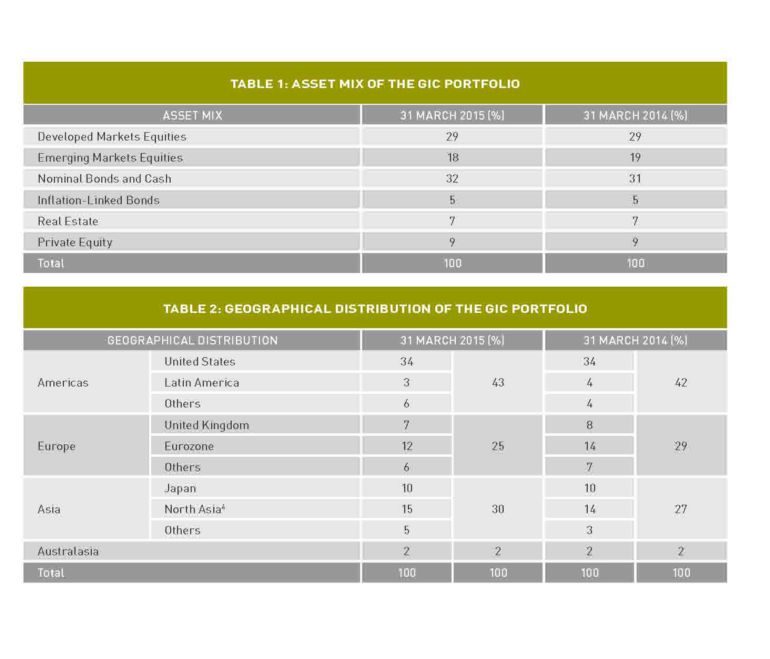

The fund is in control of over $100 billion in assets in over 40 countries and employs 1,200 people, with offices in ten cities worldwide. With a broad based portfolio spanning six core asset classes, GIC styles itself as a long-term investor prepared to endure short-term market fluctuations.

According to Lee Hsien Loong: "GIC achieved a 20-year annualised real rate of return of 4.9% for the financial year ended 31 March 2015. We cannot expect this level of returns to continue. The current high asset prices are likely to result in low returns over the next 5 to 10 years. The results underline the point that to benefit from long-term investing, we have to be prepared to tolerate short-term unrealised losses.”

GIC's interest in Eir follows a rejection by the European Commission last year of its plans to invest £1.1 billion to buy a third of the combined businesses of o2 and Three in the UK.