Global economic growth is expected to be curbed by weakening momentum in advanced economies, persistent inflation and rising trade barriers, Ibec Global has observed in its latest Global PulsePoint.

Growth is slowing in the US, the eurozone and China, but the underlying causes differ and authorities in each territory are responding differently to pressures.

The Federal Reserve is holding interest rates at 4.25- 4.5%, while the European Central Bank implements cautiously and China prioritises financial stability over stimulus by holding its rate at 3.1%, Ibec Global said.

Complicating matters further, all three territories are in the eye of a brewing trade war, which is damaging investor confidence, resulting in a fragmented policy landscape with limited coordination, where "monetary and fiscal tools are being tested by structural constraints and geopolitical shocks."

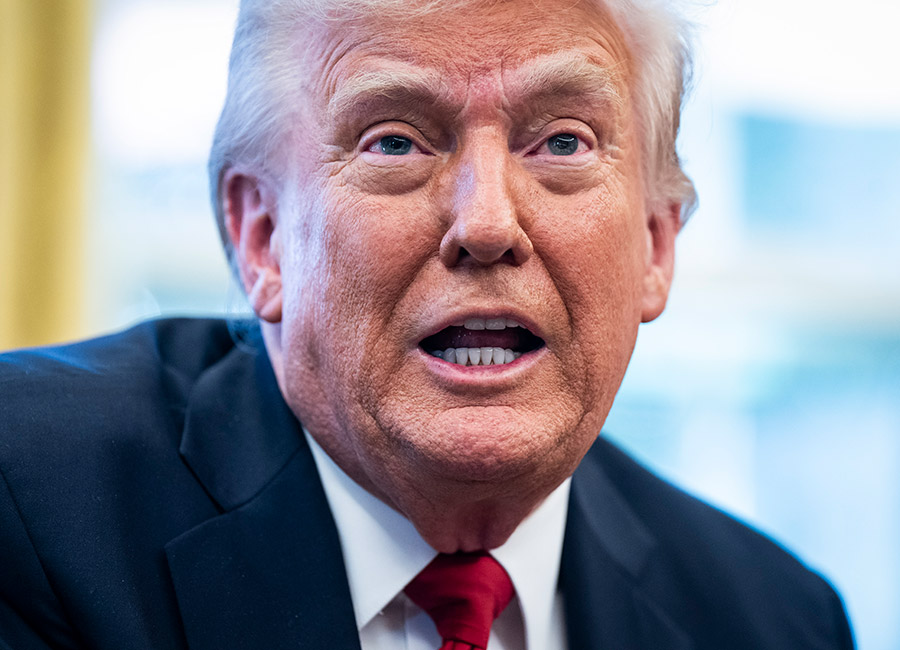

US President Donald Trump has increased tariffs on all Chinese imports from 10% to 20% while Beiling has imposed tariffs of 15% on American agricultural products.

The EU is negotiating with the US to ease newly implemented tariffs of up to 25% on European steel and aluminium, while delaying its countermeasures on US exports until April to allow more time for talks.

"Tariff escalation continues to constrain value-added exports and industrialisation, particularly in developing economies," said Ibec Global.

"Overall, rising protectionism, tariff volatility, and fragmented policy responses threaten to undermine trade flows, reinforcing the need for stronger coordination and reform."

The latest economic outlook report from the OECD has revised projected global growth down to 3.1% in 2025 and 3% in 2026.

The US economy is expected to grow 2.2% due to "trade uncertainties" and moderating domestic demand, likely both caused by the trade tariffs, while the eurozone economy growth will be sluggish at 1% due to high energy costs and weak consumer confidence.

China's outlook has been downgraded to 4.8% as structural weaknesses persist, and the OECD has warned that fragmentation risks could further dampen investment and global trade.

The rate of annual inflation currently stands at 2.8%, suggesting "moderation in inflation rather than renewed price pressures, particularly in services and housing, challenging expectations of a smooth disinflation and constraining the Fed’s policy flexibility."

Elsewhere, inflation dipped from 2.5% to 2.3% in the eurozone, and prices in China have declined 0.7% year-on-year, the first negative reading for more than a year.

"The deflationary trend complicates the Chinese policy path: while further easing may be necessary, the space for bold stimulus remains narrow amidst structural and growing debt concerns," Ibec Global said.

In the US, the S&P 500 has lost $4tn in market value due to the threat of tariffs and rising inflation, while the FTSE 100 in London has remained stable and European markets have been boosted by interest rate cuts.

In bond markets, Germany's 10-year Bund yield has risen notably in recent weeks following historic fiscal expansion to fund German defence capabilities, while China's bond yields have held steady after a gradual decline last year, suggesting a more stable outlook.

(Pic: Getty Images)