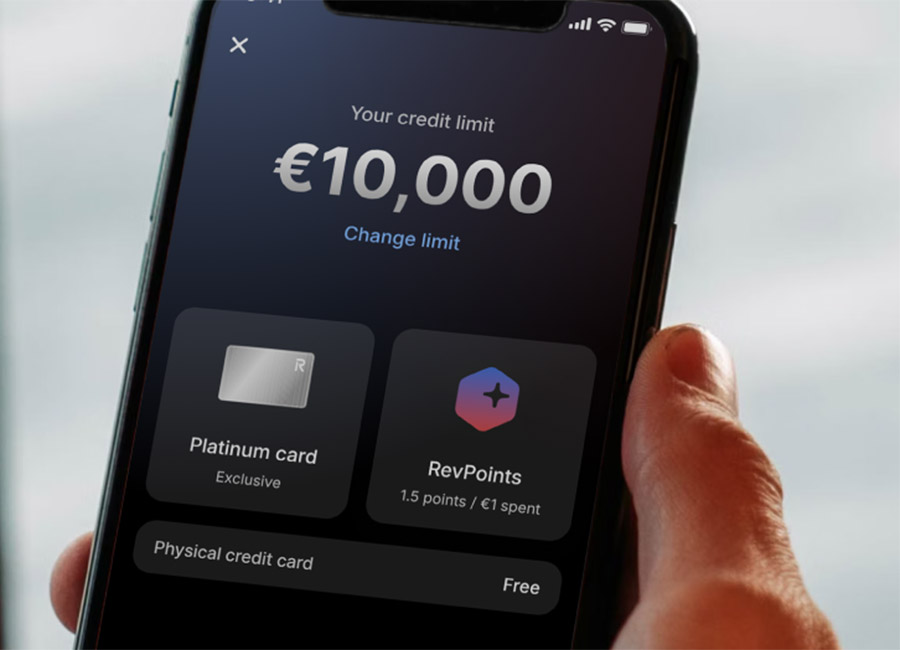

Revolut is adding RevPoints rewards to its credit card offering, meaning credit card customers will be able to earn rewards on their transactions such as airline miles, gift cards and discounts on hotel stays and other experiences.

The digital bank launched the RevPoints loyalty programme for debit card customers in Ireland last June, with users receiving points for most transactions.

The amount of points earned depends on the Revolut plan the customer is on, but all paid plan users will receive a greater earn rate of up to 2x versus their debit card.

For debit card users, Standard plan customers earn one point per €10 spent, rising to 1.5 points per €10 spent for Plus customers, 1.5 points per €4 spent for Premium customers, one point per €1 spent for Metal customers, and 1.5 points per €1 spent for Ultra customers.

For credit card customers, the rates are one point per €10 spent for Standard and Plus customers, one point per €4 spent for Premium users, one point per €2 for Metal customers, and one point per €1 for Ultra customers.

Revolut said that Ultra customers spending €2,500 per month could earn 10,000 RevPoins in less than three months, which would be enough for €200 off hotels, €200 in eSim data, or a flight from Dublin to London if redeemed for airline miles with Avios (Aer Club).

“As a business, we looked at our success with RevPoints, recognising how much value it was providing to our customers across Ireland, and saw the opportunity to give them even more ways to receive tangible rewards for their spending,” said Rob Mooney, head of lending for Revolut in Ireland.

“The response we’re seeing from customers and the growth in new sales we’re recording both highlight how much this is a credit card without compromise when it comes to value or features — and one that now rewards you handsomely for using it.”

Earlier this year, Revolu introduced 'Instalments', enabling credit card users to repay purchases at either three, six, nine or 12 monthly intervals at a rate of 9.5%. the company has a standard credit card rate of 17.99% APR.

Revolut credit card sales increased 87% last year, and the company claims to be the number one lender for new credit card sales in Ireland.

In Q1, Revolut saw a 100% increase in cards sold versus the same time in 2024, and a 50% increased versus Q4 2024. Last year, Revolut's credit card, personal loan and pay later products helped to grow its Irish loan book by 54%.

Bonkers.ie shortlisted Revolut as one of Ireland's best credit cards and named RevPoints as one of Ireland's best rewards or loyalty programmes earlier this year.

The company has more than 3m customers in Ireland.

(Pic: Supplied)