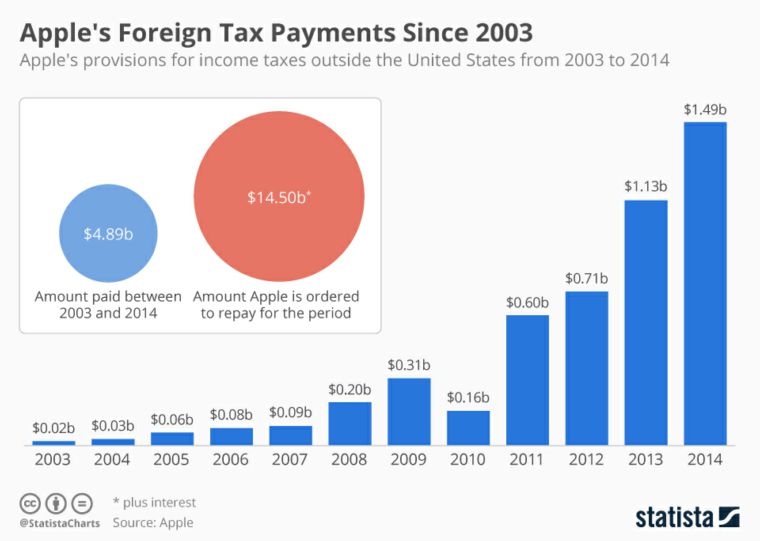

The European Commission has ruled that Ireland granted undue tax benefits of up to €13 billion to Apple. The Commission said this is illegal under EU state aid rules, because it allowed Apple to pay substantially less tax than other businesses.

Commissioner Margrethe Vestager, in charge of competition policy, said that Ireland must now recover the illegal aid, plus interest. However, finance minister Michael Noonan said he has no intention of doing so.

According to Vestager: “Member States cannot give tax benefits to selected companies – this is illegal under EU state aid rules. The Commission's investigation concluded that Ireland granted illegal tax benefits to Apple, which enabled it to pay substantially less tax than other businesses over many years.

“In fact, this selective treatment allowed Apple to pay an effective corporate tax rate of 1 per cent on its European profits in 2003 down to 0.005 per cent in 2014.”

The Commission has concluded that two tax rulings issued by Ireland to Apple have substantially and artificially lowered the tax paid by Apple in Ireland since 1991.

The rulings endorsed a way to establish the taxable profits for two Irish incorporated companies of the Apple group (Apple Sales International and Apple Operations Europe), which did not correspond to economic reality: almost all sales profits recorded by the two companies were internally attributed to a ‘head office’.

The Commission's assessment showed that these head offices existed only on paper and could not have generated such profits. These profits allocated to the head offices were not subject to tax in any country under specific provisions of the Irish tax law, which are no longer in force.

As a result of the allocation method endorsed in the tax rulings, Apple only paid an effective corporate tax rate that declined from 1% in 2003 to 0.005% in 2014 on the profits of Apple Sales International.

Noonan Rebuttal

Finance minister Michael Noonan countered that Ireland’s position remains that the full amount of tax was paid in this case and no state aid was provided. “Ireland did not give favourable tax treatment to Apple and Ireland does not do deals with taxpayers,” said Noonan.

“I disagree profoundly with the Commission’s decision. Our tax system is founded on the strict application of the law, as enacted by the Oireachtas, without exception.

“The decision leaves me with no choice but to seek Cabinet approval to appeal the decision before the European Courts. This is necessary to defend the integrity of our tax system; to provide tax certainty to business; and to challenge the encroachment of EU state aid rules into the sovereign Member State competence of taxation.”

Commissioner Margrethe Vestager (pictured above ) said her probe revealed that the tax treatment in Ireland enabled Apple to avoid taxation on almost all profits generated by sales of Apple products in the entire EU Single Market.

She added: “This is due to Apple's decision to record all sales in Ireland rather than in the countries where the products were sold. This structure is however outside the remit of EU state aid control. If other countries were to require Apple to pay more tax on profits of the two companies over the same period under their national taxation rules, this would reduce the amount to be recovered by Ireland.”

HOW THE APPLE TAX DODGE WORKS

Apple Sales International and Apple Operations Europe are two Irish incorporated companies that are fully-owned by the Apple group, ultimately controlled by the US parent, Apple Inc. They hold the rights to use Apple's intellectual property to sell and manufacture Apple products outside North and South America under a so-called 'cost-sharing agreement' with Apple Inc.

Under this agreement, Apple Sales International and Apple Operations Europe make yearly payments to Apple in the US to fund research and development efforts conducted on behalf of the Irish companies in the US. These payments amounted to about $2 billion in 2011 and significantly increased in 2014.

These expenses, mainly borne by Apple Sales International, contributed to fund more than half of all research efforts by the Apple group in the US to develop its intellectual property worldwide. These expenses are deducted from the profits recorded by Apple Sales International and Apple Operations Europe in Ireland each year, in line with applicable rules.

The taxable profits of Apple Sales International and Apple Operations Europe in Ireland are determined by a tax ruling granted by Ireland in 1991, which in 2007 was replaced by a similar second tax ruling. This tax ruling was terminated when Apple Sales International and Apple Operations Europe changed their structures in 2015.

Apple Sales International is responsible for buying Apple products from equipment manufacturers around the world and selling these products in Europe (as well as in the Middle East, Africa and India).

Apple set up their sales operations in Europe in such a way that customers were contractually buying products from Apple Sales International in Ireland rather than from the shops that physically sold the products to customers. In this way Apple recorded all sales, and the profits stemming from these sales, directly in Ireland.

The two tax rulings issued by Ireland concerned the internal allocation of these profits within Apple Sales International (rather than the wider set-up of Apple's sales operations in Europe). Specifically, they endorsed a split of the profits for tax purposes in Ireland: Under the agreed method, most profits were internally allocated away from Ireland to a 'head office' within Apple Sales International.

This 'head office' was not based in any country and did not have any employees or own premises. Its activities consisted solely of occasional board meetings. Only a fraction of the profits of Apple Sales International were allocated to its Irish branch and subject to tax in Ireland. The remaining vast majority of profits were allocated to the "head office", where they remained untaxed.

Therefore, only a small percentage of Apple Sales International's profits were taxed in Ireland, and the rest was taxed nowhere.

In 2011, for example (according to figures released at US Senate public hearings), Apple Sales International recorded profits of US$ 22 billion (c.a. €16 billion) but under the terms of the tax ruling only around €50 million were considered taxable in Ireland, leaving €15.95 billion of profits untaxed.

As a result, Apple Sales International paid less than €10 million of corporate tax in Ireland in 2011 – an effective tax rate of about 0.05% on its overall annual profits. In subsequent years, Apple Sales International's recorded profits continued to increase but the profits considered taxable in Ireland under the terms of the tax ruling did not. Thus this effective tax rate decreased further to only 0.005% in 2014.

On the basis of the same two tax rulings from 1991 and 2007, Apple Operations Europe benefitted from a similar tax arrangement over the same period of time. The company was responsible for manufacturing certain lines of computers for the Apple group. The majority of the profits of this company were also allocated internally to its 'head office' and not taxed anywhere.

Artificial Profits Allocation

Vestager observed: “The Commission's investigation has shown that the tax rulings issued by Ireland endorsed an artificial internal allocation of profits within Apple Sales International and Apple Operations Europe,which has no factual or economic justification.

“As a result of the tax rulings, most sales profits of Apple Sales International were allocated to its 'head office'" when this 'head office' had no operating capacity to handle and manage the distribution business, or any other substantive business for that matter. Only the Irish branch of Apple Sales International had the capacity to generate any income from trading, i.e. from the distribution of Apple products. Therefore, the sales profits of Apple Sales International should have been recorded with the Irish branch and taxed there.

“The 'head office' did not have any employees or own premises. The only activities that can be associated with the head offices are limited decisions taken by its directors (many of which were at the same time working full-time as executives for Apple Inc.) on the distribution of dividends, administrative arrangements and cash management. These activities generated profits in terms of interest that, based on the Commission's assessment, are the only profits which can be attributed to the 'head offices'.

“Similarly, only the Irish branch of Apple Operations Europe had the capacity to generate any income from trading, i.e. from the production of certain lines of computers for the Apple group. Therefore, sales profits of Apple Operation Europe should have been recorded with the Irish branch and taxed there.”

On this basis, the Commission concluded that the tax rulings issued by Ireland endorsed an artificial allocation of Apple Sales International and Apple Operations Europe's sales profits to their 'head offices', where they were not taxed. As a result, the tax rulings enabled Apple to pay substantially less tax than other companies, which is illegal under EU state aid rules.

The Commissioners added: “This decision does not call into question Ireland's general tax system or its corporate tax rate. Furthermore, Apple's tax structure in Europe as such, and whether profits could have been recorded in the countries where the sales effectively took place, are not issues covered by EU state aid rules.”

• Click here to view Commissioner Vestager's press conference.

Apple's Response

Apples's response to the Commission finding has been in the form of A Message to the Apple Community in Europe. The statement from CEO Tim Cook (pictured below) reads:

Thirty-six years ago, long before introducing iPhone, iPod or even the Mac, Steve Jobs established Apple’s first operations in Europe. At the time, the company knew that in order to serve customers in Europe, it would need a base there. So, in October 1980, Apple opened a factory in Cork, Ireland with 60 employees.

At the time, Cork was suffering from high unemployment and extremely low economic investment. But Apple’s leaders saw a community rich with talent, and one they believed could accommodate growth if the company was fortunate enough to succeed.

We have operated continuously in Cork ever since, even through periods of uncertainty about our own business, and today we employ nearly 6,000 people across Ireland. The vast majority are still in Cork — including some of the very first employees — now performing a wide variety of functions as part of Apple’s global footprint. Countless multinational companies followed Apple by investing in Cork, and today the local economy is stronger than ever.

The success which has propelled Apple’s growth in Cork comes from innovative products that delight our customers. It has helped create and sustain more than 1.5 million jobs across Europe — jobs at Apple, jobs for hundreds of thousands of creative app developers who thrive on the App Store, and jobs with manufacturers and other suppliers. Countless small and medium-size companies depend on Apple, and we are proud to support them.

As responsible corporate citizens, we are also proud of our contributions to local economies across Europe, and to communities everywhere. As our business has grown over the years, we have become the largest taxpayer in Ireland, the largest taxpayer in the United States, and the largest taxpayer in the world.

Over the years, we received guidance from Irish tax authorities on how to comply correctly with Irish tax law — the same kind of guidance available to any company doing business there. In Ireland and in every country where we operate, Apple follows the law and we pay all the taxes we owe.

The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws and upend the international tax system in the process. The opinion issued on August 30th alleges that Ireland gave Apple a special deal on our taxes. This claim has no basis in fact or in law. We never asked for, nor did we receive, any special deals. We now find ourselves in the unusual position of being ordered to retroactively pay additional taxes to a government that says we don't owe them any more than we've already paid.

The Commission’s move is unprecedented and it has serious, wide-reaching implications. It is effectively proposing to replace Irish tax laws with a view of what the Commission thinks the law should have been. This would strike a devastating blow to the sovereignty of EU member states over their own tax matters, and to the principle of certainty of law in Europe. Ireland has said they plan to appeal the Commission’s ruling and Apple will do the same. We are confident that the Commission’s order will be reversed.

At its root, the Commission’s case is not about how much Apple pays in taxes. It is about which government collects the money.

Taxes for multinational companies are complex, yet a fundamental principle is recognized around the world: A company’s profits should be taxed in the country where the value is created. Apple, Ireland and the United States all agree on this principle.

In Apple’s case, nearly all of our research and development takes place in California, so the vast majority of our profits are taxed in the United States. European companies doing business in the U.S. are taxed according to the same principle. But the Commission is now calling to retroactively change those rules.

Beyond the obvious targeting of Apple, the most profound and harmful effect of this ruling will be on investment and job creation in Europe. Using the Commission’s theory, every company in Ireland and across Europe is suddenly at risk of being subjected to taxes under laws that never existed.

Apple has long supported international tax reform with the objectives of simplicity and clarity. We believe these changes should come about through the proper legislative process, in which proposals are discussed among the leaders and citizens of the affected countries. And as with any new laws, they should be applied going forward — not retroactively.

We are committed to Ireland and we plan to continue investing there, growing and serving our customers with the same level of passion and commitment. We firmly believe that the facts and the established legal principles upon which the EU was founded will ultimately prevail.