Grant Thornton’s Sasha Kerins and Cantor Fitzgerald’s Conor McKeon explain how the Employment and Investment Incentive Scheme works

In recent times, many SMEs have looked to alternative sources of raising capital to fund growth and development. The Employment and Investment Incentive Scheme (EIIS) has proved an attractive source of alternative capital for early-stage high-growth Irish companies.

One of the sole remaining tax reliefs against total income, the EIIS appeals to taxpayers subject to tax at the higher rate. EIIS is a split tax relief, with 30% available in the year of investment and a further 10% in year four, provided the investee company has satisfied criteria surrounding job creation and/or research and development expenditure. Relief for the investor is subject to an annual investment limit of €150,000 each year until 2020.

The investee company, which may be bound by an indemnity, is responsible for ensuring it does not invalidate the individual investor tax relief or it may be liable to the investors for any tax relief clawed back, i.e. where the company is sold within the minimum investment period of four years, thereby invalidating the relief.

Eligible Companies

EIIS capital is available to most trading SMEs, including agri food, retail, technology and media. There are a number of businesses specifically ineligible, including professional services companies, those dealing in or developing land, forestry, operations in the coal industry or in steel or ship building sectors.

For EIIS purposes, SMEs are companies with less than 250 employees, a turnover not exceeding €50m or balance sheet value not exceeding €43m. The company must be either a new company or have traded for less than seven years.

If a company has traded for more than seven years, funding may be raised for a new product or entry into a new market, where the total investment is expected to be greater than 50% of the average annual turnover for the prior five years.

Approval should be obtained from the Revenue Commissioners prior to raising funding under the EIIS. Outline approval may be initially sought, though this does not guarantee that full approval will subsequently follow. Grant Thornton has assisted a number of clients in the Revenue application process.

For approved companies, Revenue will issue an EII2 certificate. This enables the company to issue EII3 certificates to the investors, which is used to claim tax relief. There is a lifetime limit of €15m that may be raised under the EIIS by a qualifying company, and the maximum capital that may be raised in any 12-month period is €5m. Raising EIIS funding may impact eligibility to obtain state aid or grant funding which should be considered prior to investment.

A company may be obliged to buy back EIIS shares after the minimum holding period of four years. If the company is not in a position to meet these obligations at the end of the four-year period, the EIIS shares may convert into share capital. The exit strategy must be at the fore of the company’s agenda from the inception of the investment process right through the four-year holding period to ensure there are adequate reserves to fund an exit to investors.

Investors

Investors also have the option to invest in specialist EIIS investment funds. Cantor Fitzgerald aims to complete multiple fundraises each year, encouraging clients to spread their investment across each of its offerings. The level of EIIS funds raised has increased steadily each year since its introduction in 2011, with a total of circa €90m raised in 2015. Of this, Cantor Fitzgerald raised around €9.8m for three individual companies and a combined total in excess of €24m.

EIIS relief is available to investors who are not connected (as defined in tax legislation) to the investee company in either the two years before or four years after the investment. Income tax relief on investments is up to a maximum of €150,000 in any one tax year, and relief should be claimed within two years from the end of the year of investment.

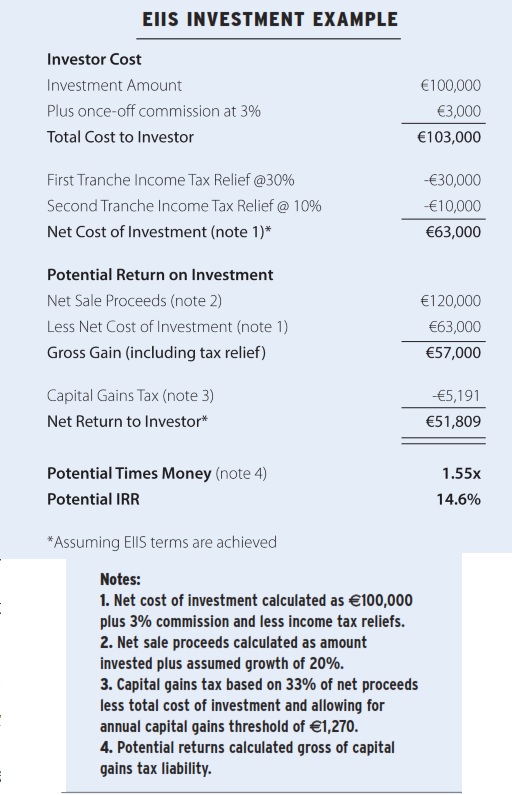

The total tax relief available to an investor is currently 40%, which is obtained in two tranches over a four-year period. An initial 30% relief is obtained in the year the investment was made i.e. for an investment made in 2016, the investor will get relief of 30% in their 2016 tax return. The remaining 10% relief is obtained in year four of the investment. The final 10% relief is subject to the investee company meeting certain criteria relating to increased employment or R& D investment

Set out below is an illustrative example of the potential return to an EIIS investor on an investment of €100,000, assuming the value of the business grows by 20% over the term of the investment. Under current rules, the cost of the original investment is deductible against the sales proceeds for capital gains tax purposes.

Investment Risk

All investments carry risks and there is a possibility that an investee company may not succeed as planned, resulting in a loss on disposal. In such circumstances, any loss arising may be subject to certain restrictions linked to the income tax relief claimed.

The EIIS is favourable to spouses/civil partners, who can obtain tax relief on investments of €150,000 each, i.e. €300,000 per couple in any 12-month period. Investments made under the EIIS between 16 October 2013 and 31 December 2016 are not affected by the High Earners Restriction. Based on current tax legislation, tax relief on investments made on or after 1 January 2017 will be considered a specified relief subject to the High Earners Restriction.

Other Reliefs

Other reliefs which may apply to entrepreneurs who are considering setting up their own business include Start-up Refunds for Entrepreneurs (SURE) and Start Your Own Business Relief (SYOB).

SURE operates to grant entrepreneurs setting up a new company a refund of income tax paid over the six tax years prior to the investment. The refund is limited to 41% of the capital invested. SYOB relief applies to individuals unemployed for 12 months or more who start up a new business as a sole trade before 31 December 2016. The relief operates to provide an exemption from income tax subject to a maximum of €40,000 for two years.

Photo: Sasha Kerins, Tax Partner with Grant Thornton, and Conor McKeon, Head of Corporate Finance with Cantor Fitzgerald