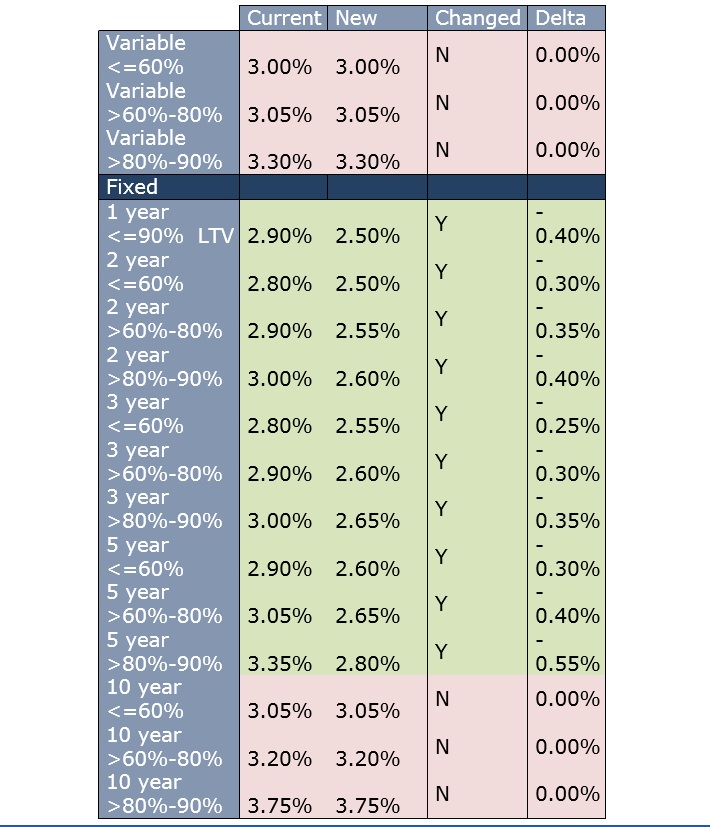

KBC Bank is to reduce a range of its fixed mortgage rates by between 0.25% and 0.55%, while maintaining its 10-year fixed rates.

The bank said that it will reduce its one-, two-, three- and five-year fixed rates, which will be available to new and existing KBC mortgage customers, effective from September 3.

“This reduction is part of our ongoing commitment to provide customers with better long term value and lower mortgage repayments,” said Fergal O’Riagain (pictured), who was appointed KBC Bank’s new director of products in April of this year.

“Our new rates mean greater choice for first-time buyers and greater value for movers and switchers, while allowing them to have certainty of repayments and also save money.

“Combined with our current account discount and €3,000 switcher support, this entire package makes KBC the obvious choice in the Irish market today for mortgages.”

In addition to the new rates, KBC said that all of its mortgage customers can continue to avail of the 0.20% mortgage rate discount where a KBC Current Account is maintained, i.e. where customers open and mandate their salary to a KBC Current Account and pay their mortgage from that account.

* All rates incorporate 0.20% current account discount available to customers