Sponsored Content

The Strategic Banking Corporation of Ireland’s range of low-cost liquidity products are helping businesses recover from a rollercoaster 2020

While 2020 will be remembered as a year of huge setbacks for businesses, it will also be remembered as a year where many businesses – and SMEs in particular – proved their ability to adapt under pressure and pivot to emerge successfully from the Covid-19 pandemic.

The Strategic Banking Corporation of Ireland (SBCI) has continued throughout this time to deliver low-cost liquidity into the SME finance market, supporting business owners at a time when they need it the most. Through its non-bank partners (Bibby Financial Services, Capitalflow, FEXCO, Finance Ireland and SME Finance & Leasing), the SBCI has supported financial products, such as Term Lending, Leasing, Hire Purchase and Invoice Finance, through the provision of low-cost liquidity and guarantees.

Significantly, the SBCI has extended its capabilities as a risk-sharing provider in 2020, supported by the government, the European institutions and in partnership with its bank partners (AIB, Bank of Ireland, KBC, Permanent tsb and Ulster Bank), to assist Irish firms seeking to protect their business against Covid-19 and Brexit, but also to expand, grow and invest for the long-term.

Covid-19 Support Measures

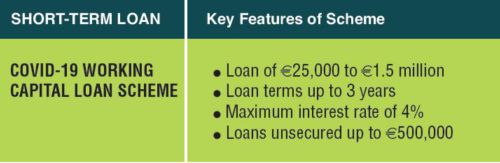

In the immediate aftermath of the first lockdown in March, the SBCI brought the Covid-19 Working Capital Loan Scheme to the market, as a first line of defence for those businesses who found themselves suddenly facing the unique challenges and disruption brought about by Covid-19. By the end of November, more than 4,000 businesses had applied for eligibility for this short-term scheme and over €120m had been sanctioned. This scheme also allowed businesses plan for reopening as restrictions were eased.

In addition, the Covid-19 Credit Guarantee Scheme was announced by the Tánaiste in July, as part of the government’s stimulus package. The original scheme capacity has been expanded by €2bn and enables borrowers, including primary producers, who have been adversely impacted by a minimum of 15% in actual or projected turnover or profit due to Covid-19 and are having difficulty in accessing credit, to apply for low-cost funding that might not otherwise be available to them. To date, this medium-term scheme has shown a steady take-up, with 1,400 loans totalling around €70 million already drawn down.

The Covid-19 CGS is open for applications until the end of June 2021. The number of finance providers through which the scheme is available is also expected to be expanded significantly.

Strategic Investments

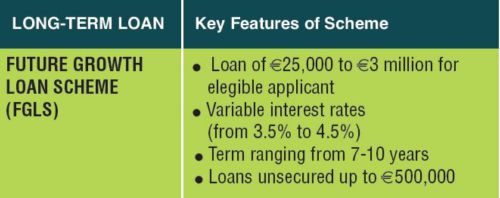

Towards the end of the summer, the Future Growth Loan Scheme, the SBCI’s long-term funding support, was expanded by a further €500m, bringing the total scheme funding to €800m. This additional funding is now available to eligible SMEs, the primary agriculture (farmers) and seafood sectors (including fishing) to support strategic long-term investment.

The Scheme aims to enable Irish businesses to expand, diversify or improve their productivity, and to address the competitiveness gap that may emerge through reluctance on the part of SME owners to fund investment in their business using debt. To date, around €500m has been sanctioned under the Future Growth Loan Scheme, which has also seen the number of its providers expand, with Permanent tsb announced as a new on-lender partner in November.

sbci.gov.ie

@SBCIreland

Pictured: Nick Ashmore, CEO of the Strategic Banking Corporation of Ireland