Various factors are driving the ongoing transformation of the accountancy profession, not least the rise of artificial intelligence and emergence of private equity

The continuing evolution of the accountancy profession in Ireland is clear from this year’s Business Plus survey, with participants highlighting how regulatory complexity, technological advancements and shifting ownership structures are reshaping the landscape.

“The continued rise of private equity investment in the sector has introduced new dynamics, with some firms navigating the balance between financial returns and investing in the future,” Niall May, managing partner at RSM, says.

“Increased compliance demands — particularly around ESG, tax and governance — are placing greater expectations on firms to deliver strategic advisory alongside traditional services.

“Talent retention and workplace culture remain key challenges. As firms scale and evolve, ensuring a positive, client-focused working environment is critical.”

Tom O’Brien, managing partner at Forviz Mazars, believes regulatory and technological change and the advent of artificial intelligence (AI) stand out as the most influential factors driving the significant transformation of the profession.

“Many of our clients face headwinds driven by a mixture of geopolitical uncertainty, climate risk, regulatory pressure and changing demographic trends in the Irish workforce,” he says.

“The prevalent driver for 2025 is undoubtedly digital disruption.

“The latest generation of AI tools are not only reshaping competition and market demands, but also presenting huge risks and strategic challenges for many of our clients.”

Frank Walsh, managing partner at Walsh O’Brien Hartnett, says the rapid rise in the use of AI and its impact is something the firm is working on closely with some of its clients.

“Reporting and standardisation of processes, together with mapping out areas where AI may assist in delivering efficiencies are common themes we’re dealing with for our clients — whilst being mindful of the dangers and limitations some of the AI tools currently possess.”

Data analytics and real-time reporting are now shaping much of the professional development at RBK, whose clients are increasingly looking for proactive, data-driven insights, Joe Cleary, managing partner, notes.

“To meet this, we have invested in technology and team upskilling.”

Observing the sector as a whole, he says advisory services have grown as businesses seek strategic insights beyond compliance.

“Cloud-based accounting and automation have streamlined operations, while ESG reporting has become a further requirement.

“Looking ahead, we anticipate continued growth in financial advisory, digital solutions and compliance consulting as businesses navigate an evolving economic and regulatory landscape.”

A wave of consolidation is continuing in the sector in light of regulatory complexity, rising client expectations and the need for scalable operations, he continues.

“Mergers and acquisitions are now key strategies for expanding services, market reach and technology investment.

“RBK is actively engaged in this evolving landscape if the appropriate opportunities present themselves.

“We’re conscious of the potential of strategic mergers to strengthen our expertise, broaden our advisory capabilities and expand our reach to a larger client base.

“We expect it to also help ensure we remain at the forefront of industry innovation.”

While Walsh O’Brien Hartnett is committed to remaining independent, Walsh believes the renewed interest in consolidation shows the faith that consolidators have in the profession and the long-term importance placed on firms to continue to deliver value added services to clients.

“Each firm has to look at their own structure and decide what suits best for their organisation, at each point in its evolution,” he says.

“We believe staying independent facilitates better service for our clients and offers our team greater opportunity to progress within our firm.”

The significant amount of consolidation in the accountancy sector in Ireland over the past few years follows the trend which started in the UK many years ago, Dylan Byrne, managing partner at OSK, explains.

“This has been primarily driven by private equity funds seeing the recurring-fee nature of our business model as an attractive alternative investment with potentially better returns.

“Consolidation can be good for competition, particularly in terms of building larger international accountancy firms, and can also be a good exit mechanism for retiring partners.”

However, he notes that a consequence of consolidation for SME clients can be increased fees and a loss of partner-led service as the new business model focuses on the bottom line.

O’Brien of Forviz Mazars says the emergence of private equity within the accountancy profession in Ireland continues to be a topical issue, but the outcomes of the model have yet to be proven.

“As a truly integrated, global accountancy firm, we firmly believe in the value proposition for clients and our people from having an integrated, multidisciplinary approach that can provide services seamlessly and consistently on a cross-border basis.”

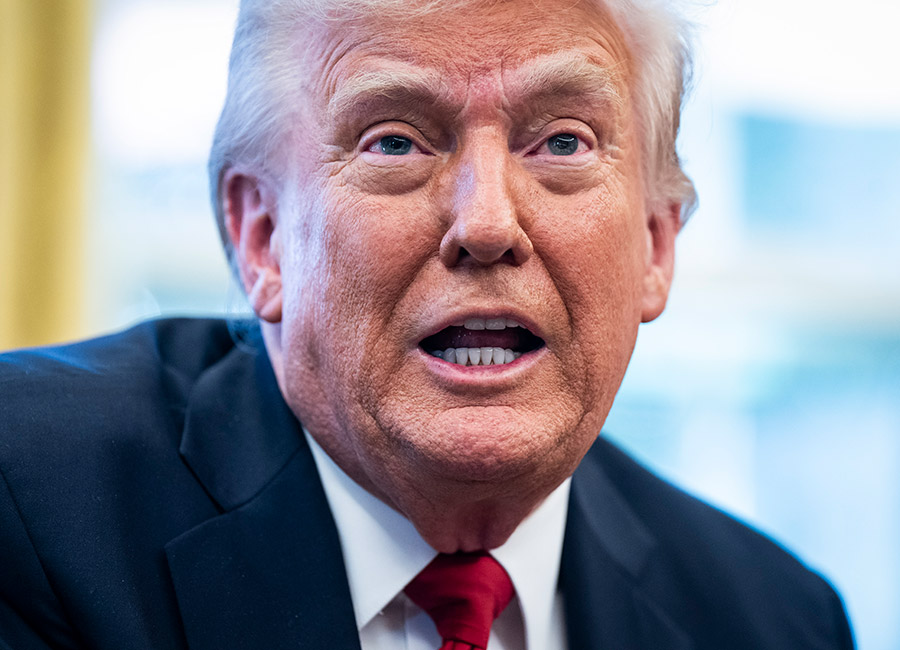

Participants in this year’s survey are unanimous about the impact of the re-election of Donald Trump as president in the US on their clients and the Irish economy.

Mark Butler, managing partner, HLB Ireland, sums it up: “The reinstatement of the Trump administration has introduced a degree of volatility and uncertainty in the global trade environment, particularly concerning EU-US relations. Our firm is closely monitoring the situation to advise our clients effectively.

“We recommend that businesses adopt flexible strategies and strengthen their scenario planning capabilities to adapt to potential trade policy changes quickly.”