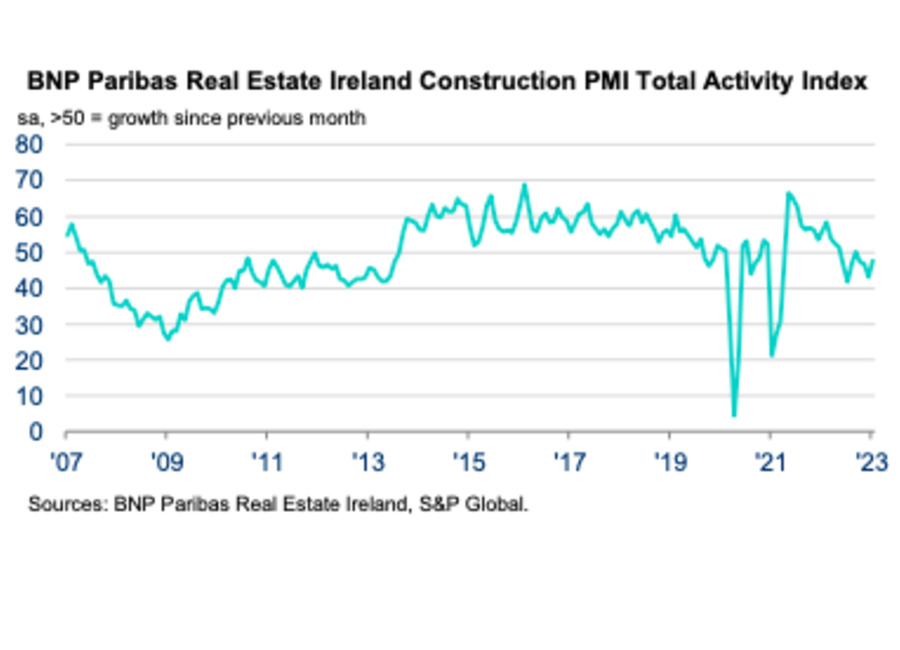

The construction sector was characterised by "sustained contraction" in January as subdued market conditions led to reductions in output and new orders, albeit at softer rates than in December, the latest BNP Paribas Real Estate Ireland construction PMI shows.

Employment increased during the month, and cost and supply chain pressures displayed signs of easing, while the rate of input cost inflation slowed to a two-year low and lead times lengthened to the shortest extent since February 2020.

The headline seasonally adjusted construction total activity index measured 47.7, up from 43.2 the previous month while still below the 50.0 no-change mark, making January the fourth successive month of decline in Irish construction output.

The contraction in activity was broad-based but softer month-on-month across the three monitored categories, with civil engineering (44.2) recording the strongest decline for the 11th consecutive month.

Commercial activity (49.0) contracted the least, and housing activity (45.2) decreased for the fourth month running. Firms reported struggles in securing new orders, but the reduction measured was the joint-weakest in the current 10-month sequence.

The sustained drop in output and demand led firms to reduce input buying for the eighth successive month, but at the slowest rate since October, and the increase in employment was marginal.

Prices reportedly continued to rise across a broad range of products, but the rate of inflation was the least pronounced for two years, although sub-contractor rates increased at an accelerated and marked pace.

January data pointed to sustained falls in sub-contractor availability, usage, and quality. That said, in all three cases rates of decrease softened from December. In fact, the rate of decline in availability was the weakest in 28 months.

The outlook for activity over the coming 12 months brightened in the first month of 2023, with confidence strengthening to an 11-month high.

Optimism reportedly stemmed from hopes that demand conditions would improve in the future, with new projects set to begin in the coming months.

“Construction slowed slightly in January, but this month’s PMI is distinctly more upbeat than those of recent months. Although input costs are still rising, the rate of increase is at its slowest for two years," said John McCartney, director and head of research at BNP Paribas Real Estate Ireland.

"Meanwhile, supply chain delays have eased somewhat, perhaps reflecting the reopening of the Chinese economy. Moreover there are positive signs for the year ahead.

"The relaxation of bank and local authority mortgage rules, and the raising of price caps in the government’s shared equity scheme will give builders greater confidence in future selling prices.

"Meanwhile the new Renter Tax Credit and a widening of the net for social housing support will help underpin the rental market.

"With confidence at an 11 month high, housing commencements have picked-up strongly in recent months, construction firms have resumed hiring, and 85% of builders now expect to be as busy or busier in one year’s time.”

(Pic: Getty Images)