Davy, Ireland's largest stockbroker, has produced a report on Ireland's exposure to developments in Ukraine as the Russian assault continues.

Apart from the price of oil & gas, Ireland appears to be relatively insulated against the impacts from the fighting in eastern Europe, as Russia accounts for just 0.4% of goods exports.

That amounted to €1.2bn of goods exported in 2021, with a negligible share of services trade with Russia. There was also a negligible share of services trade with Ukraine in that period.

According to the report, Ireland’s concentration in defensive export sectors such as pharmaceuticals and services trade means supply-chain issues will be less acute. A more significant channel may be the impact of higher consumer price index inflation, by 1-1.5pp, if current high energy prices are sustained. However, Irish household savings in 2021 were relatively high, providing a cushion to sustain spending.

The report also highlights that Ireland’s export sector is defensive by nature, concentrated in agri-food, business services, information and communications technology, pharmaceuticals and medical- technology, therefore the country is less exposed to cyclical capital goods-producing industries that have been more exposed to supply-chain disruption.

This is partially evident in Ireland’s current lower rate of producer price inflation (3.5% in January) versus the euro area (10% in December), meaning any direct trade exposure for Ireland is relatively small.

From a banking point of view, Ireland has "minimal to no" direct exposure from Ukraine, with the IFSC accounting for any exposure, although that is facilitated by international banks and will mean no direct impact on the Irish economy.

And while inflation is building, Irish household savings will leave them in a good position for 2022, with the saving rate for 2021 forecast to be 21%, which the report noted was high by European standards.

This will mean Irish savings are likely to fall during 2022 in order to maintain spending within the economy.

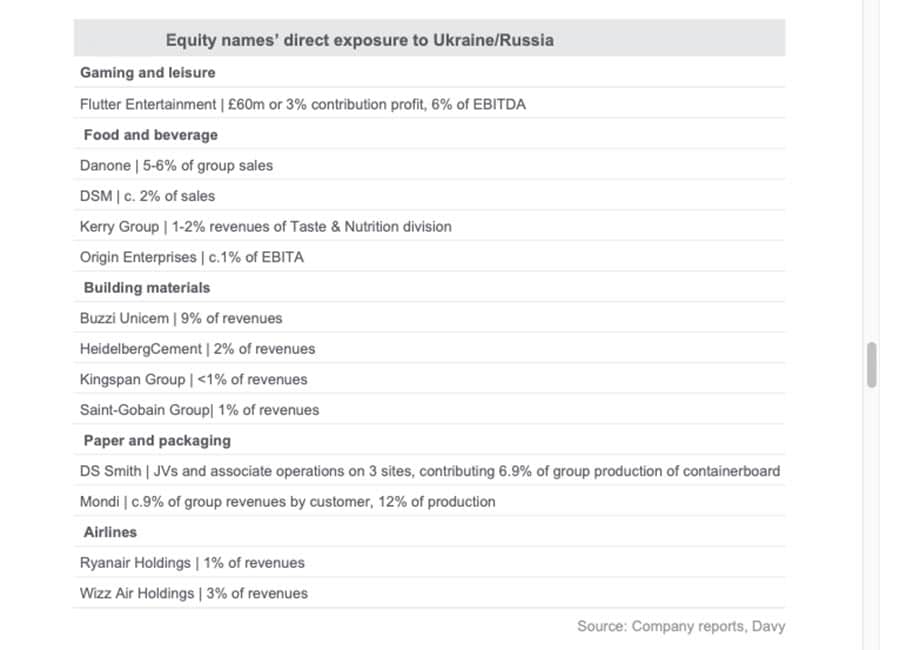

A number of Irish companies do face exposure to the Russia/Ukraine war, with the likes of Ryanair, Danone, Flutter Entertainment (owner of Paddy Power), the Kingspan Group and Kerry Group exposed.

Ireland's aircraft leasing sector are set to be impacted by sanctions on Russia, with 5% or 130-135 of AerCap's inventory based in Russia. The company have said they will comply fully with the sanctions, meaning that it will terminate its leases by March 28th and attempt to physically extract as many of these aircraft as possible.

Elsewhere Tullow Oil is benefitting from the higher oil prices.