Output in the manufacturing sector further declined in November in line with demand, but input price inflation slowed to a 21-month low, the latest AIB Ireland manufacturing purchasing managers' index (PMI) shows.

While the overall PMI fell for the seventh time in eight months from 51.4 in October, the 48.7 reading indicated the first deterioration in operating conditions in the goods-producing sector since May 2020 when Ireland was in Covid lockdown.

Four of the five components that make up the single-figure indicator of manufacturing performance fell, most notably output, while stocks of purchases were slightly stronger than in October, marking it as the exception.

"The AIB Irish Manufacturing PMI moved into contraction territory in November, with the headline index dropping below 50 to 48.7, having been confined to a narrow 51-52 range over the previous four months," said Oliver Mangan, chief economist at AIB.

"The fall in the index is no surprise as new orders have been in decline since June, and this has eventually resulted in a downturn in activity in the sector.

"It brings Ireland into line with the trend seen elsewhere in recent months - the flash manufacturing PMIs stood at 47.6, 47.3 and 46.2 in the US, Eurozone and UK in November. Overall, this was a weak Irish report."

New orders experienced a "sustained drop," with new business now having declined for six successive months, the longest sequence of contraction for 13 years. The rate of decline was the fastest since August 2009, when excluding the pandemic period.

AIB said the weak demand reflected pessimism regarding a potential recession, high inflation deterring customers and previous overstocking by clients. New export orders, however, fell at the slowest rate during the six-month period of decline.

"New orders, including export orders, declined for a sixth consecutive month, registering quite a sharp fall in November. This led to a renewed drop in output, the fifth decline in the past six months," Mangan said.

The drop in new orders caused the renewed fall in output. The rate of decline in production was the sharpest since August, excluding Covid. The level of finished goods in stock rose for the fifth month running as firms built buffer stocks and maintained output at a higher level than new orders.

Backlogs declined for the seventh consecutive month, and at the fastest rate since June 2020 indicating that pressure on capacity has eased further. Input stocks rose overall for the 20th month running, reflecting lower output and receipt of previously ordered items.

Similarly, buying activity by manufacturers fell for the fourth time in five months, and at the strongest rate since June 2020. Companies also cut employment for the first time since September 2020, albeit only marginally.

Lead times lengthened to the smallest degree since August 2020, in a further sign of recovering supply chains. The proportion of firms reporting longer suppliers' delivery times fell to 18%, compared with the long-run average of 12%.

Reduced demand for inputs contributed to a further easing of cost pressures in November. Input price inflation slowed to a 21-month low, but remained elevated overall reflecting high energy and raw material prices, AIB said.

Similarly, output price inflation slowed to a 20-month low, but remained at a higher level than in any period prior to April 2021.

"Inflationary pressures, while still elevated, are easing, with the rate of increase in input prices at its lowest in 21 months and output price inflation at a 20-month low," Mangan said.

"In terms of the 12-month outlook, sentiment while still positive, fell to its joint-lowest level in the past two years, as fears of a recession mount."

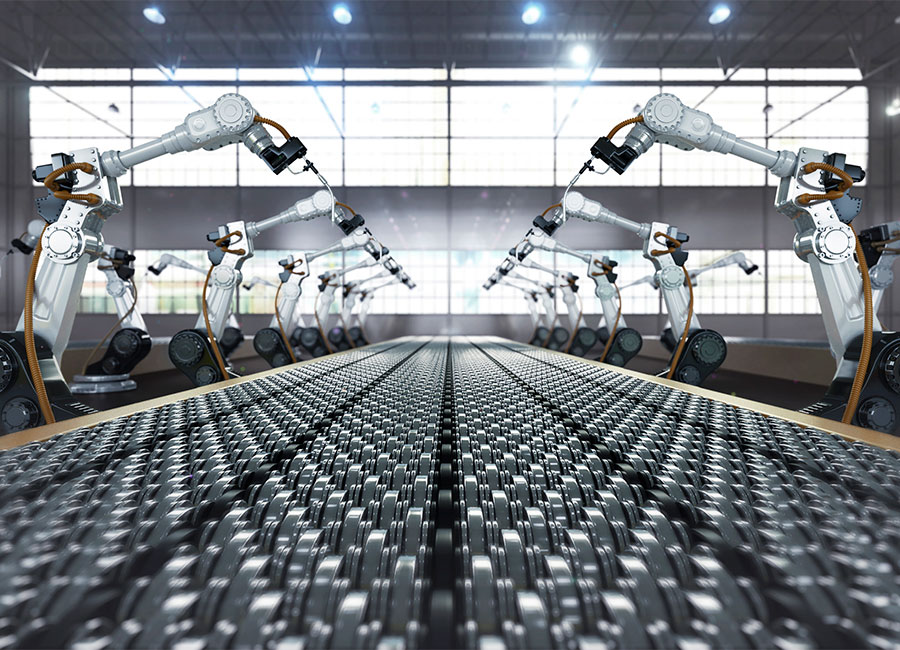

(Pic: Getty Images)