Behind schedule and with a huge taxpayer cost per connection, the roll-out of the National Broadband Plan isn't going smoothly, writes John Kinsella.

The Comptroller & Auditor General (CAG) ran the rule over the implementation of the National Broadband Plan (NBP) in his recent annual report, and the picture that emerged isn’t encouraging. Three years ago, in November 2019, the Department of the Environment, Climate and Communications tasked National Broadband Ireland (NBI) to design, build, operate and manage the broadband network over a 25-year period.

Delivery of the plan is being funded by government subsidy, NBI commercial revenues and investor funding. The state subsidy is capped at €2.7bn, most of it payable over the first ten years of the contract. The contracted deployment plan is a seven-year build programme, scheduled for completion by January 2027. The department has stated that the programme is currently 12 months behind schedule.Under the original contract, the delivery milestones envisaged c.200,000 premises passed by the end of January 2023. At the end of September 2022, 85,400 premises had been passed, so that January target will not be met.

In all, NBI’s contract is to provide access to fibre broadband to c.562,000 premises in provincial and rural areas that commercial broadband providers aren’t interested in. How many of these premises are prepared to stump up for fibre broadband is a moot point. In September take-up rate for the NBP subsidised fibre broadband was 24%, or 20,500 premises.

NBI expects take-up to be lower in the early stages due to consumers being under contract with existing providers. In rural areas, possibly by the end of the decade, broadband options will contract when Eir’s existing copper network services are turned off, after the NBI fibre network is rolled out. The NBP roll-out is behind schedule largely due to Covid lockdown factors. There are also ongoing operational hurdles that National Broadband Ireland has to confront, such as access to Eir ducts to lay its fibre.

A recent dispute that had to be sorted out by ComReg, the Commission for Communications Regulation, related to NBI wanting to undertake its own duct blockage clearance and repair process, rather than availing of Eir’s ‘Sub-Duct Self Install’ product. The French company refused to play ball, forcing ComReg to intervene in the dispute with a legalistic determination that urged Eircom to cop on.

Outside of the NBP territories, Eir has its own fibre broadband programme. The company markets two types of ‘fibre’ broadband: the souped-up copper wire version called VDSL, and the real thing that results from a new cable in the premises. For the latter type of real fibre broadband, at the end of Q2 2022 Eircom claimed it had passed 864,000 premises with a fibre connection, of whom 264,000 had availed of the service.

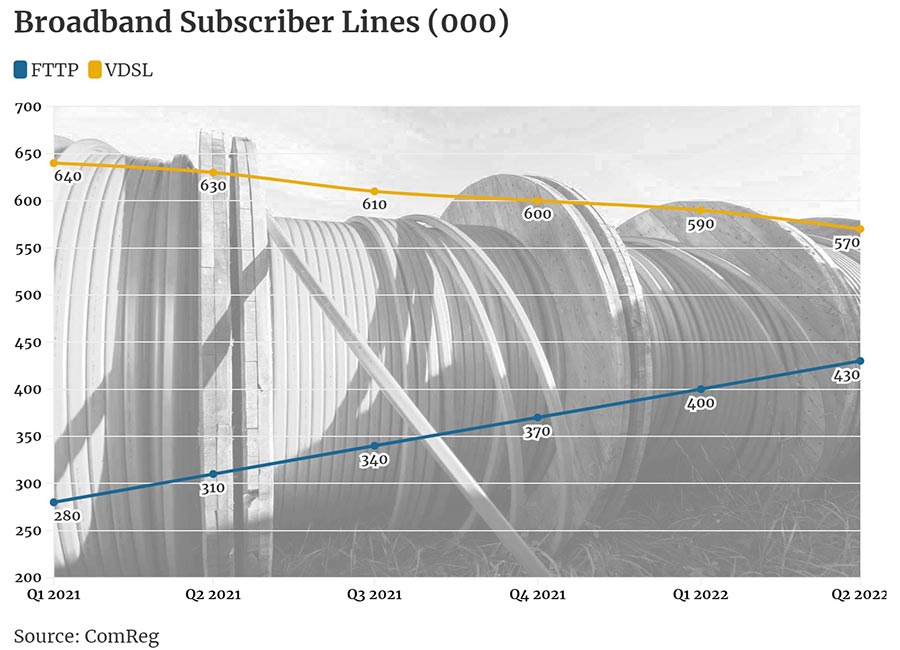

Not all those Fibre To The Premises (FTTP) customers are signing up to Eir. ComReg counted 431,000 FTTP broadband connections in June 2022, and said Eir had 31.4% market share, equivalent to 135,000 connections. Of 1.6m fixed broadband connections at the half-way point this year, FTTP accounted for 27% compared with 20% a year earlier. The company with the largest FTTP market share is Vodafone, on 36%, followed by Eir, and then Sky on 18%.

Like Eir, Vodafone is involved in building out its own fibre broadband network through Siro, its joint venture with ESB. Siro says it has passed 450,000 homes and business premises and has a target of 770,000. Though Siro’s focus to date has been outside the main urban centres, cable laying activity has accelerated in the capital. Siro recently announced that it plans to introduce a full fibre network to over 70,000 homes and businesses across south Dublin and the Dun Laoghaire-Rathdown local authority area. The roll-out will take about two years, with Vodafone and ESB committing €50m to the project.

Like NBI, Siro and Eir wholesale their fibre broadband service to resellers, which explains why Sky is number three player in the FTTP market. The UK company has never dug a hole in the ground but its marketing and bundling expertise is second to none. The cable share of the fixed broadband market is 23%, a proportion that has hardly budged in recent years. The dominant cable broadband provider is Virgin Media, and going forward the company sees merit in reselling the Siro product too.

Between them, Eir, NBI and Siro claim to have passed 1,390,000 premises with FTTP connections. With 431,000 FTTP connections logged by ComReg, that means the take-up rate for the super shiny broadband is 31%. For many households and businesses, the VDSL fibre from the cabinet service is all they want, and that may not change very much until Eir switches off the copper network.

According to a 2021 European Commission study, Ireland’s rural coverage of FTTP was only 4%, compared to an EU average of 21%, which can be partly explained by the country’s low population density and rugged geography. Indeed, the study noted that these demographic and geographic conditions “highlighted the need for state intervention in underserved areas”.

Civil servants in the Department of Communications decided the best way forward for the National Broadband Plan was using fibre cable connections. The CAG reported that the department allocated €370m for the roll-out of the NBP in 2020 and 2021. Because of delays, at the end of 2021 the payments to National Broadband Ireland totalled €177m.

The CAG found at the end of January 2022 the number of premises passed was 34,460. Divide that into €177m and you get a cost per pass of €5,100. Then factor in the take-up rate of 24% and the taxpayer cost per customer connection using National Broadband Plan infrastructure works out at €21,400.

That is something of an exaggeration, as NBI can claim a proportion of subsidy when individual ribbons are completed — 50% of the total value of a milestone, with the 50% split between the number of ribbons as a proportion of premises passed in each ribbon. This allows a 12-month backstop period from completion of the first ribbon within the deployment area to the completion of the final ribbon within the deployment area. Subsidy payments are only made once NBI achieves the related milestones, and the independent certifier issues a milestone achievement certificate.

In February 2022, delay sanctions were introduced by the department, which apply where there is a delay of more than 28 days in achieving build-related milestones. In the context of the overall contract, the penalties are meaningless, with delay sanctions totalling €134,800 applied to end of August 2022.

As rural dwellers wait for NBIto accelerate out of the Covid setback, private sector operator Imagine is building out its Fixed WirelessAccess (FWA) broadband network, which provides fast broadband with a cable. Unlike National Broadband Ireland, Imagine does not receive a taxpayer subsidy.

ComReg reported that Fixed Wireless Access (FWA) connections grew 12% to 84,000 in the year to June 2022 — the same as number of premises passed by NBI in September. In its wisdom, the Department of Communications assessed and rejected the merits of FWA when deciding on the National Broadband Plan.