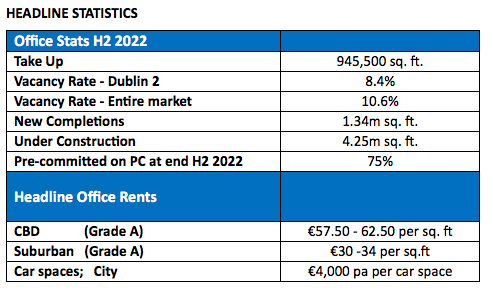

Property firm HWBC reports that office rents in Dublin have “performed well” in the first half of the year, with prime city centre rents rising by 9% to €62.50 per square foot and suburban rates by 5% to €34 per square foot.

The company also reports that any fall-off in demand for space from tech companies will be taken up by other sectors, while buildings with poor energy ratings and sustainability credentials are falling out of favour.

“The Dublin office market delivered a strong start to the year despite global uncertainty caused by war in Ukraine, rising energy costs and the start of a new cycle of interest rate hikes to tackle inflation,” says HWBC’s Dublin Office Review for H1 2022.

More than 4.5 times the amount of space has been let in the six months than in the first half of 2022, at 945,000 sq ft, with foreign direct investors accounting for four of the five biggest deals.

Significant deals included Service Now pre-leasing 88,000 sq ft at 60 Dawson Street, and Fiserv taking the whole of Kennedy Wilson’s 10 Hanover in the South Docks.

However, there are risks to recovery, with tech firms in particular reviewing their requirements.

TikTok has reportedly opted out of plans it had to lease a 177,000 sq ft building on Sir John Rogerson’s Quay, and Twitter is planning to sub-let a floor of its offices on Cumberland Street.

The report says that HWBC expects any fall in demand from ‘big tech’ occupiers will be taken up by other sectors, with large mandates from financial and professional services firms. Global names such as Citi, EY and Deloitte are all actively reviewing office locations, with more than 600,000 sq ft of requirements between them.

Despite the strong pipeline of demand, overall Dublin office vacancy rate has increased slightly to 10.6%, as occupiers get to grips with the new reality of the ‘hybrid work’ model. There continues to be significant ‘grey’ space coming to the market, as companies that are adjusting their office space to suit hybrid work preferences look to sub-let their excess space.

Three-quarters of the 1.34 million sq ft completed is already spoken for, including Spencer Dock (425,000 sq ft), One Wilton (152,000 sq ft) and Two South County (102,000 sq ft), all pre-let to Salesforce, LinkedIn and Mastercard.

There is an increasing divide in the market, according to the survey, with new space built with top-tier sustainability credentials in high demand and able to command premium rents compared to older less energy-efficient buildings.

HWBC predicts that buildings with poor energy ratings will continue to fall out of favour with occupiers, and that landlords will seek to sell to reduce exposure, or embark on energy-efficient retrofitting or redevelopment.

Investment director Iain Sayer said: “The improvement in the market that started as pandemic restrictions eased at the end of last year has continued into the first half of this year. Rent levels have increased and there has been a sharp rise in take up of new space.

"With strong pipeline demand and healthy levels of reserved space, the second half of 2022 is expected to see similar levels of appetite for the best new city space. Although some technology companies are reviewing their pace of growth, we expect to see other sectors such as pharma, life sciences, professional and financial services become more dominant in terms of activity.”

There’s more information and the full review on the HWBC website here.