After a record-breaking 2021, the global IPO market took a sharp turn in the opposite direction in 2022, according to analysis by EY.

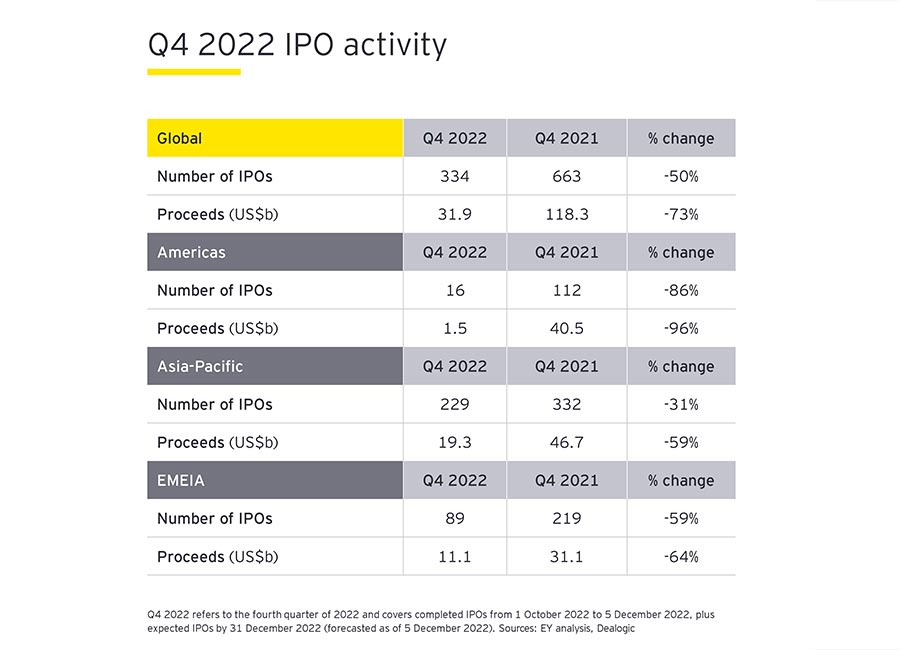

The EY Global IPO Trends 2022 report counts 1,333 IPOs raising $179.5bn year to date, down 45% and 61% by number of deals and proceeds, respectively, year-over-year.

While these numbers represent a stark decline from 2021, global IPO deals still turned up a 16% increase by number when compared to pre-pandemic 2019.

“A record year for IPOs in 2021 gave way to increasing volatility from rising geopolitical tensions, inflation and aggressive interest rate hikes,” said Paul Go, EY Global IPO Leader. “Weakened stock markets, valuations and post-IPO performance have further deterred IPO investor sentiment.”

Go observed that amid an environment defined by higher inflation and rising interest rates, investors have spurned new public companies and turned to less risky asset classes. Similarly, financial-sponsored IPO activity took a steep fall of 77% and 93% by number and proceeds, respectively.

Most special purpose acquisition companies (SPACs) listed from late 2020 are also reaching their two-year window, and they must now either find a target to merge or return the IPO proceeds to their investors.

Go added that the technology sector continued to lead by volume accounting for 23% of deals, while the energy sector dominated by proceeds, accounting for 22% in 2022.

Fergal McAleavey, EY head of corporate finance, commented: “Subdued investor sentiment toward high growth technology stocks in particular has resulted in significantly depressed share prices, this has led to private equity funds running the rule over many companies to unlock value via taking them private. evidenced last week where Coupa Software agreed to a $8bn take private by Thoma Bravo.”

Among listed mega IPOs, which are defined as those that raised proceeds of more than US$1bn, the average proceeds in 2022 are 45% higher than those in 2021, on the back of strong valuation for the mega energy IPOs that took place this year.

“Certain markets such as Mainland China, Middle East and some ASEAN countries have performed relatively well despite the significant global underperformance,” Go stated.

The Americas’ IPO activity sank to lows not seen since the peak of the great recession. It hit a 13-year low by volume and a 20-year low by value.

The Asia-Pacific IPO market had 845 IPOs totalling $120bn in proceeds, accounting for 63% of deals and 67% of funds raised globally in 2022. Mainland China is on course to set another record in the highest annual capital raising by the close of 2022.

EMEIA IPO activity fell by 53% and 55% by number and proceeds, respectively, recording 358 IPOs raising US$50bn.

MENA was up 115% by proceeds as it benefited from the large energy and other IPOs completed, coupled with the initiative rolled out by the government’s privatization plan.

Go expects IPO activity to be “sombre” through at least the first quarter of 2023, favourable conditions seem to be set in place for the global IPO activities to regain greater momentum by the second half of the year.

“Many prospective IPO companies are still going to take the wait-and-see approach, holding out for the right window,” said Go. “For now, investors will focus more on a company’s fundamentals, such as revenue growth, profitability and cash flows, over just growth projections.”

Go added that as there is a positive correlation between companies’ post-IPO share price performance and the communication of their ESG strategies, investors will also increasingly be looking at the company’s ESG agenda.

Image: Fergal McAleavey, EY head of corporate finance