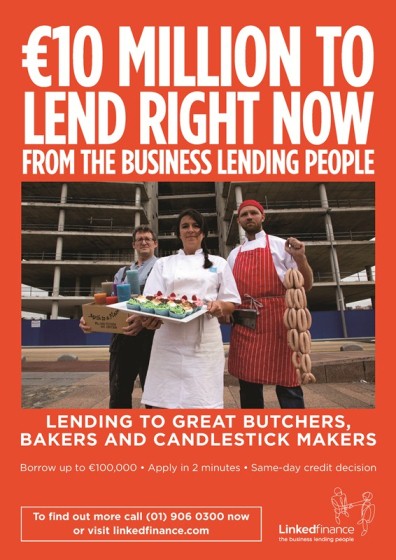

A growing business can't justify waiting eight weeks for a loan decision from traditional banks. Linked Finance, the market leader in Peer to Peer (P2P) lending, offers SMEs a viable lending solution and currently has €10 million on the table to lend. The initial application only takes two minutes, with the majority of their credit decisions made within one working day.

Business owners in general are finding that traditional banks are slow to respond to their needs, so they are looking at alternative options for much-needed funds to help them as they try to expand and develop their businesses. Linked Finance, which facilitates P2P lending, offers a viable solution for firms that want to grow. SMEs no longer have fill out 12-page application forms and wait two months for a loan decision from their bank.

The application process on Linked Finance only takes two minutes on its website (www.linkedfinance.com) and 90% of credit decisions are made within one working day. Through Linked Finance, established businesses can borrow anything from €5,000 to €100,000, and the process is designed to be straightforward.

Peter O'Mahony: Founder, Linked Finance

€10 Million Loan Finance

Currently, Linked Finance has €10 million available to lend. These funds come from 10,000 registered lenders who are willing to lend to established businesses across all sectors, with very attractive interest rates. Established companies such as VIT HIT, Cornucopia restaurant in Dublin and Killowen Farm yoghurt in Wexford have all benefited from borrowing through Linked Finance.

Linked Finance's lenders are members of the public — Irish residents who are looking for a better return on their savings. According to Central Bank figures, Irish household savings in June 2015 totalled €89bn. That’s a lot of money out there to lend to SMEs. Linked Finance lenders include a number of high-profile business entrepreneurs, such as Superquinn founder Fergal Quinn and Bobby Kerr of Dragons' Den fame.

Worldwide Phenomenon

The confidence in P2P lending is rising rapidly in Ireland and has already proven to be a worldwide phenomenon. In 2014, €15bn was lent by P2P lenders worldwide. That’s a lot of money bypassing the banks.

Linked Finance plans to lend over €200m to SMEs in the coming years. Any established and creditworthy business, whether it is a limited company, sole trader or business partnership, can apply for a loan online, where the application takes less than two minutes to complete.

Lending Expertise

Frontline Ventures recently made an investment of €2.5 million in Linked Finance, which has allowed the firm to grow from two people to a staff of 16 in the past six months. Plans are in place to double this number by the end of 2015. Senior members of Linked Finance’s staff have a wealth of hands-on experience in running their own companies, with a combined 60 years of expertise in SMEs. This gives them in-depth insight into what a small business needs.

Once a loan is live on Linked Finance, SMEs can enjoy all the benefits of marketing their products and services to the over 10,000 lenders who have signed up to actively support Irish businesses.

Linked Finance is prepared to lend to all types of established Irish businesses.

How To Apply

Any established Irish business can apply for a loan now by visiting www.linkedfinance.com or emailing info@linkedfinance.com. Who knows, hundreds of these lenders may also become some of your most loyal customers.