The value of mergers and acquisitions (M&A) in Ireland rose 3% year-on-year to €57bn in 2024, according to law firm Philip Lee.

The 834 M&A transactions recorded last year represented an annual increase of 6% as well as a record high.

The role of private equity in transaction activity was notable, with a 103% year-on-year increase in institutional buyouts and secondary buyouts combined.

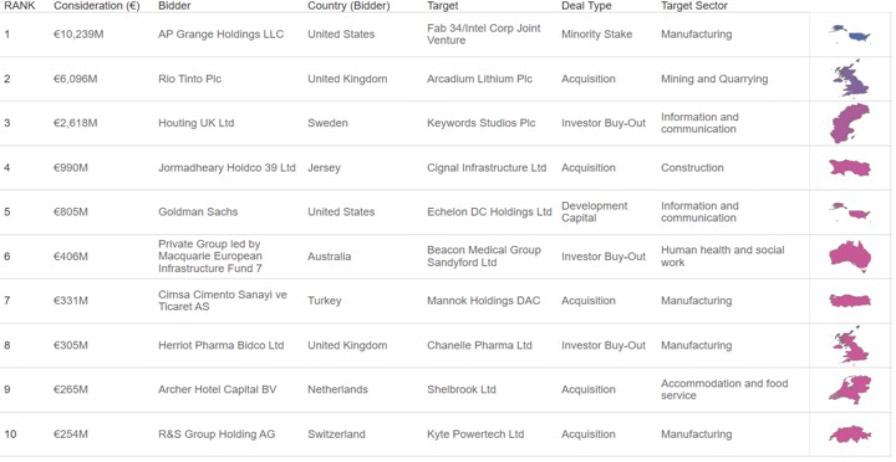

The total value of private equity transactions topped €20bn for the first time following Apollo Global Management's purchase of a 49% stake in Intel's Fab34 advanced chip manufacturing facility in Leixlip for €10bn.

Despite a small decline in strategic corporate dealmaking, there was an 87% increase in buyout volume and a 6% increase in venture capital transactions year-on-year, following trends seen in the UK and elsewhere globally.

From a sectoral standpoint, technology was the strongest performer, representing a quarter of all Irish deals, and UK companies were the number one bidders for Irish assets.

Eoghan Doyle, partner and head of corporate and M&A at Philip Lee, said 2025 had begun with "vibrant levels of deal activity" despite dealmakers coming to terms with macroeconomic and geopolitical uncertainty.

"One cannot ignore the fact that Ireland is exposed in this new age of Trump economics. That said, Ireland is not alone in that context, and not for the first time in recent years, Irish businesses face some serious challenges to remain globally competitive," he warned.

"Over the last number of years, the data in our reports and elsewhere has repeatedly shown the resilience of Irish businesses and the strength of the investment case for Ireland.

"We are cautiously optimistic that the trend continues where a number of economic forecasts predict a positive growth outlook for 2025.”

Doyle, who co-authored the report with Andrew Tzialli, said the real effects of the current uncertainty are more likely to land in 2026 and beyond.

"That, coupled with Ireland’s robust business case (including its stable and pro-business political, tax and economic regime), and an existing wall of capital to be deployed by private equity funds, we expect another strong year for M&A activity in Ireland," he concluded.

The technology, media and telecommunications sector drove deal volume in Ireland last year with 211 transactions, representing a 17% increase from 2023, fuelled by investors trying to capitalise on AI, cybersecurity and the digital transformation.

Overseas investment did not hit the heights seen in 2023 and 2023 in volume terms, but 190 inward deals closed last year.

The value of inward transactions increased 176% to reach €24bn, bolstered by big-ticket deals such as EQT's €2.6bn takeover of Keyword Studios, and Rio Tinto's €6bn offer for Shannon-based Arcadium Lithium.

UK investment in Ireland increased 3% year-on-year to 80 transactions, and British firms were active across financial services, specifically insurance. US companies completed 37 transactions, largely in technology and manufacturing.

There were 115 outbound transactions in 2024, down 18% from the year prior, and the value of those mergers and acquisitions was €6.1bn, a decrease of 70% from more than €20bn in 2023, the lowest total since 2020.

The UK remains the leading target for Irish firms, ahead of the US, Germany, Australia and Spain.

The largest outbound deal of the year was Paddy Power parent Flutter Entertainment's €2.3bn acquisition of Italian gaming operator Snaitech.

Photo: Eoghan Doyle. (Pic: Paul Sherwood Photography)