Dublin-based Kota has raised $14.5m in a Series A funding round, bringing the total amount raised by the insurance benefits platform and API firm to $22.9m.

The company has also obtained authorisation from the Central Bank, making it one of the few technology platforms in Ireland to be regulated.

The round was led by European investment group Eurazeo, along with existing investors EQT Ventures, Northzone, Frontline Ventures and new investors 9Yards and Plug and Play.

The funding will be used to expand employment, increase the variety of insurance carrier partners in Kota's products, and accelerate customer acquisition ahead of the introduction of pension auto-enrolment next June.

Kota aims to do for the $70bn employee benefits market what "Revolut did for banking," by providing a "modern, user-first experience" that integrates directly with insurers and pension providers.

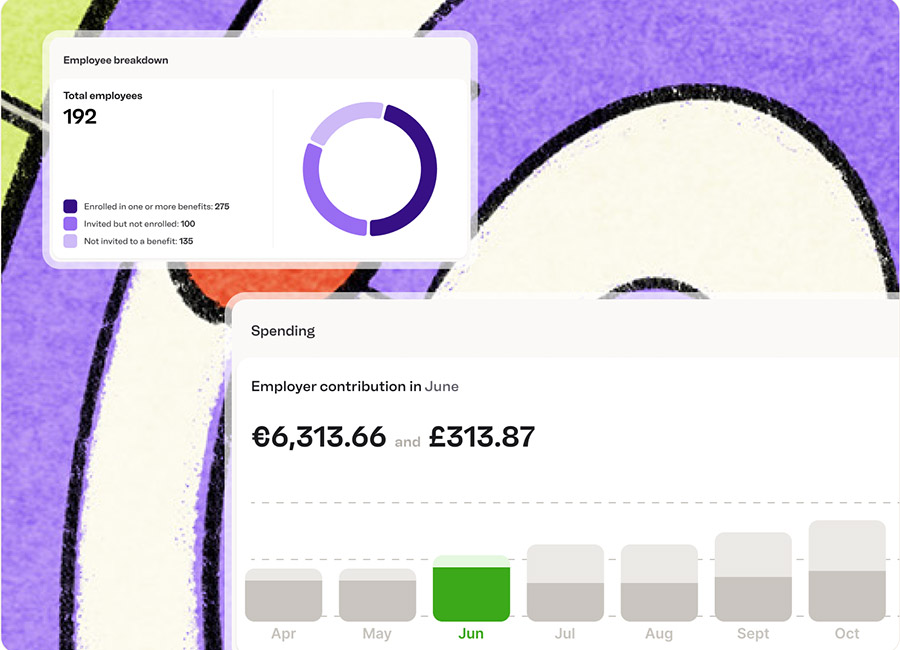

The company aims to give employees real-time access and control of their work benefits through its platform, and HR teams a single, reliable platform to manage everything.

“Employee benefits, which can make up 25% of total compensation, are systematically undervalued and expensive. I experienced this as a founder and a GM –– managing benefits in email, between brokers and insurance companies, completely disconnected and alien from anything else in the business. It's entirely out of date," said Luke Mackey, founder and CEO of Kota.

"Ultimately, no one on the team connected or engaged with them, no matter how much we invested. It's not surprising. Insurance benefits are delivered in clunky portals or in PDFs, which is so unengaging compared to the financial experiences employees are used to.

"Kota integrates directly with insurance companies so we can control that experience and make it easy to roll out and run benefits, no matter who you are or where your team is. This means that employees can quickly understand, enrol, access coverage, retirement plans, or other benefits, and actually value them.”

Since launch in 2023, the Kota platform has been used by hundreds of SMEs to manage employee benefits, and tens of thousands of employees to understand and value their cover.

The platform is integrated with leading insurers such as Irish Life Health in Ireland, Vitality in the UK, ONVZ in the Netherlands, Sanitas in Spain and Allianz Global Care globally.

It is also the benefits platform for choice for Remote.com and leading scale-ups like Zoe Health, Poolside, Carwow, Tines, &Open and Protex AI.

Last year, the company launched Kota Embed, an embedded insurance offering for HR platforms to make insurance benefits available to their customers without leaving their HRIS or Payroll tool.

"Kota really stood out to us," said Elise Stern from Eurazeo, which has €36.8bn in diversified assets under management and 13 offices across Europe, Asia and the US.

"With a tech-first approach, they’ve built a robust technical and financial infrastructure: deep integrations with insurers across dozens of countries, visibility across the benefits stack, and a seamless API that allows partners — from HRIS to payroll — to embed benefits natively.”

Photo: (l-r) Kota's Deepak Baliga, director of engineering; Luke Mackey, CEO; and Patrick O'Boyle, CTO. (Pic: Supplied)