Shares in Hibernia REIT, one of the country's largest commercial landlords, have risen by more than a third after it recommended that shareholders accept a €1.1bn takeover offer from Canada's Brookfield Asset Management.

Benedict Real Estate Bidco, a subsidiary of one of Brookfield's real estate private funds, has offered €1.63 for each share in Hibernia REIT comprised of an offer price of €1.60 per share and the company's forthcoming 3.4c dividend.

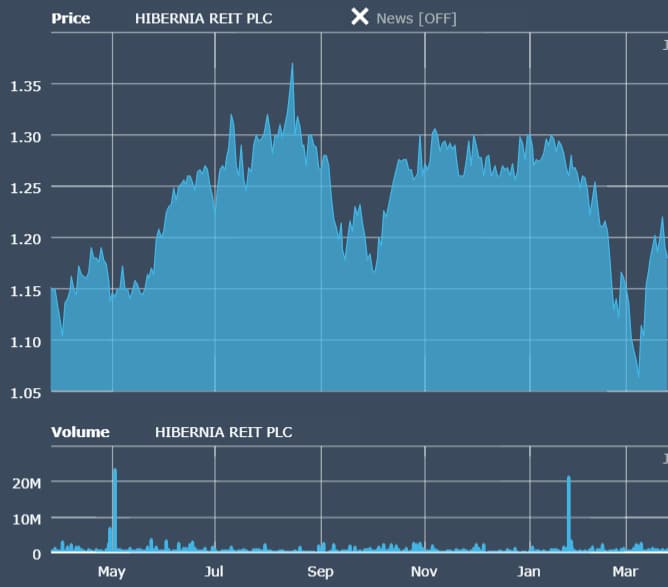

Hibernia REIT said the offer represents a 35.6% premium on its closing price of €1.18 per share on Thursday, and a 33.9% premium on its volume weight average share price of €1.22 in the three months to 24 March.

Danny Kitchen, chair of Hibernia REIT, said the company had traded at a "persistent discount" of its net tangible assets per share "despite significant progress against its strategic objectives" and strong track record of investment.

Hibernia agreed to lease 288,500 sq ft in its Harcourt Square office development to KPMG last December, two months after confirming the €152m sale of its Dockland Central property in Dublin's north docks.

"The acquisition recognises the company's prospects and the quality of its portfolio of assets and delivers an acceleration of the value we expect to be created from completion of Hibernia REIT's major office development projects," Kitchen added.

"The acquisition allows Hibernia shareholders to realise the value of their investment in cash at a significant premium to Hibernia REIT's prevailing share price and a premium to its EPRA NTA per share at 31 December 2021, when taking account of the directors' current estimates of expected latent tax and debt breakage costs for Bidco," the company stated.

Brad Hyler, managing partner and head of European real estate at Brookfield, said: "We have built a strong relationship with Hibernia REIT's management team and are excited to partner with them in the next phase of the company's development by combining Brookfield's global real estate expertise with Hibernia's established operating platform and portfolio of high-quality standing and development assets in Dublin's most strategic submarkets.

"We look forward to supporting Hibernia REIT as they continue to create value by capturing demand from top global tenants for modern, sustainable buildings with best-in-class amenities and wellness credentials in prime locations."

The terms of the deal are final unless Hibernia receives a better offer, which Bidco is allowed to match or beat.

Hibernia has been advised on the deal by Credit Suisse and Goodbody, and the company board has unanimously recommended the takeover.

Brookfield manages c.$690bn worth of assets - including a 200m sq ft office portfolio and total real estate valued at $250bn - covering areas such as infrastructure, renewable power and transition, private equity and credit.