Revolut has launched joint savings accounts for holders after its joint account offering more than doubled its active user base last year.

The digital bank said that joint savings accounts were the most requested feature by existing account holders.

Consumers who open a joint savings account can earn interest at a rate of up to 2.5% AER, depending on their Revolut plan.

The rates available to joint savings account holders range from 1.7% for Standard and Plus customers to 1.85% for Premium, 2% for Metal and 2.5% for Ultra.

There is no cap on the amount of interest that can be earned, and interest is paid daily.

Revolut, which has upwards of 3m customers in Ireland, said there are no account fees for joint accounts.

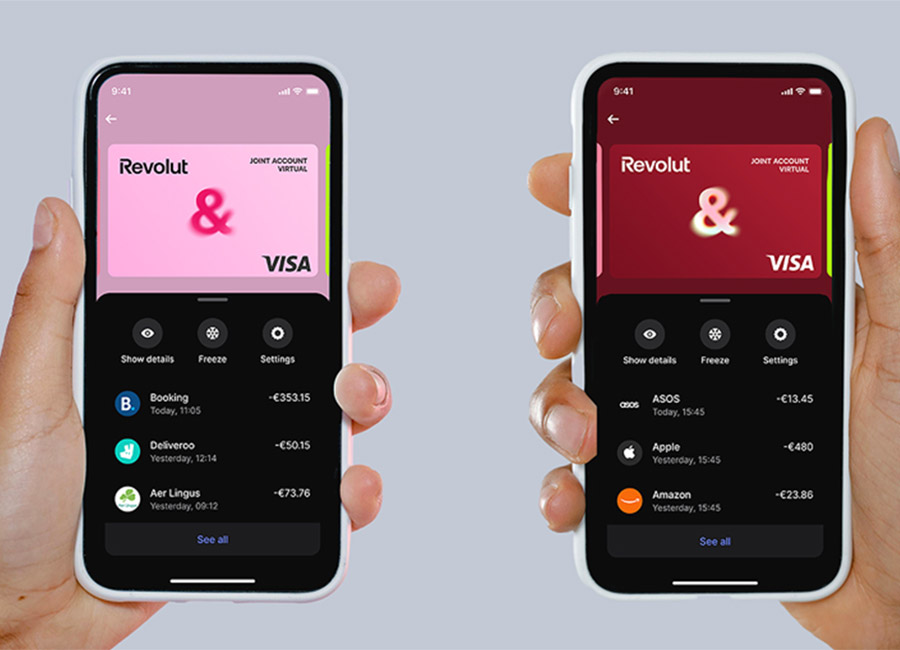

Customers can get matching physical and virtual cards and link their accounts to Apple Pay or Google Pay.

“Earlier this year, we looked at the desires of our existing Joint Account customers and couples were very clear with us — they wanted a way to save together with Revolut, and earn competitive daily interest in doing so," said Josh Moloney, product owner of joint accounts at Revolut.

"We’ve now made that a reality and expect to see an uptick in new Joint Account customers as greater numbers of consumers choose to make Revolut their primary bank.”

Malcolm Craig, general manager at the Irish brand of Revolut Bank, added: “Our ‘one app, all things money’ approach to people’s finances really resonates when considering our Joint Account product,”

“We know maximum transparency is incredibly important to a large percentage of our Irish customer base when it comes to collective finances and our new Joint Savings accounts enable exactly that.

"This instantly gives couples across the country a boost and access to a feature they’ve long been asking us for — all without setting foot in a branch.”

A survey for Revolut conducted by Dynata found that two in five Irish people agreed that "maximum transparency: a joint bank account" was the best way to manage expenses.

A random sample of 1,000 people were questioned for the research.

(Pic: Supplied)