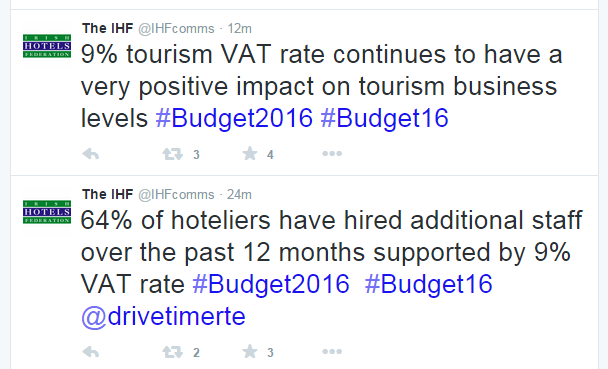

Minister Michael Noonan announced there will be no change to the 9% VAT rate for the tourism sector in the Budget 2016.

The Irish Hotels Federation (IHF) welcomed the announcement. Tim Fenn, IHF CEO said the rate provides support for employment growth, citing the 33,000 new jobs in tourism since the rate was brought in in 2011.

“The 9% VAT rate is of enormous importance to the industry, helping to level the playing field for Irish tourism when competing with international destinations. As a result, Irish tourism is now on track to create a further 40,000 jobs over the next five years,” said Fenn.

“By bringing our tourism VAT in line with our European competitors, it has contributed to increased tourism demand and significant growth.” According to the IHF, 95% of hoteliers say the 9% tourism rate will help them hire new staff and retain exisiting staff during the next year.

Last year, Ireland attracted 7.3 million overseas visitors and total tourism revenue was €6.45 billion. This year, visitors to Ireland are said to surpass 7.8 million.

IHF Welcomes Retention of 9% VAT

Vintners’ Federation of Ireland (VFI)

The Vintners’ Federation of Ireland (VFI) welcomes the Budget 2016 decision to narrow the gap in tax credits between self-employed and PAYE workers.

Pub owners and other self-employed business owners are not entitled to the PAYE tax credit of €1,650. Under the new budget, they are said to receive €500 next year.

The VFI has long called for more equality for self-employed people and small business owners. “We believe that publicans and other small business owners are at a significant disadvantage compared to other sectors when it comes to state supports.”

Speaking on the decision not to reduce excise duty, the VFI said: “We view this as a missed opportunity by the Government as Ireland still has excise levels that are a multiple of most other European countries.”

The VFI believes today’s announcement will have a positive impact on publicans across the country. It welcomes the reduction in capital gains tax for entrepreneurs and the release for micro-breweries.