Bartra Healthcare has sold a portfolio of nursing homes to Belgian REIT Aedifica for c.€161m.

The facilities, with capacity for 617 residents, consist of two brand new nursing homes in Loughshinny (Skerries) and Northwood (Santry), HSE transitional care unit in Beaumont (Artane), and forward purchase of Clondalkin Lodge nursing home, which is currently under development.

The Loughshinny and Northwood nursing homes can accommodate 246 residents in ensuite bedrooms specifically tailored to suit the needs of elderly people requiring continuous care. Clondalkin Lodge Nursing Home is under development and the 150-bed facility will open in 2023.

Following surgery and treatments for accidents or major illnesses in an acute hospital it is often necessary for patients to spend a further period of recovery before returning home. Beaumont Lodge (pictured) is a step-down facility specifically designed to provide ongoing medical monitoring, and reablement for patients. It can accommodate 221 patients

Declan Carlyle, CEO of Bartra Healthcare, commented: “This is a very exciting and positive step for Bartra Healthcare and our excellent team. The transaction will further strengthen our position in the Irish nursing home sector, and we are looking forward to developing our services and expanding our portfolio of homes.

“Aedifica represent a great partner and fit for us regarding our ethos and values, and it is important to note that neither residents nor employees will be impacted by the change in ownership. Bartra Healthcare will also operate Aedifica’s care home that is currently under development in Crumlin.”

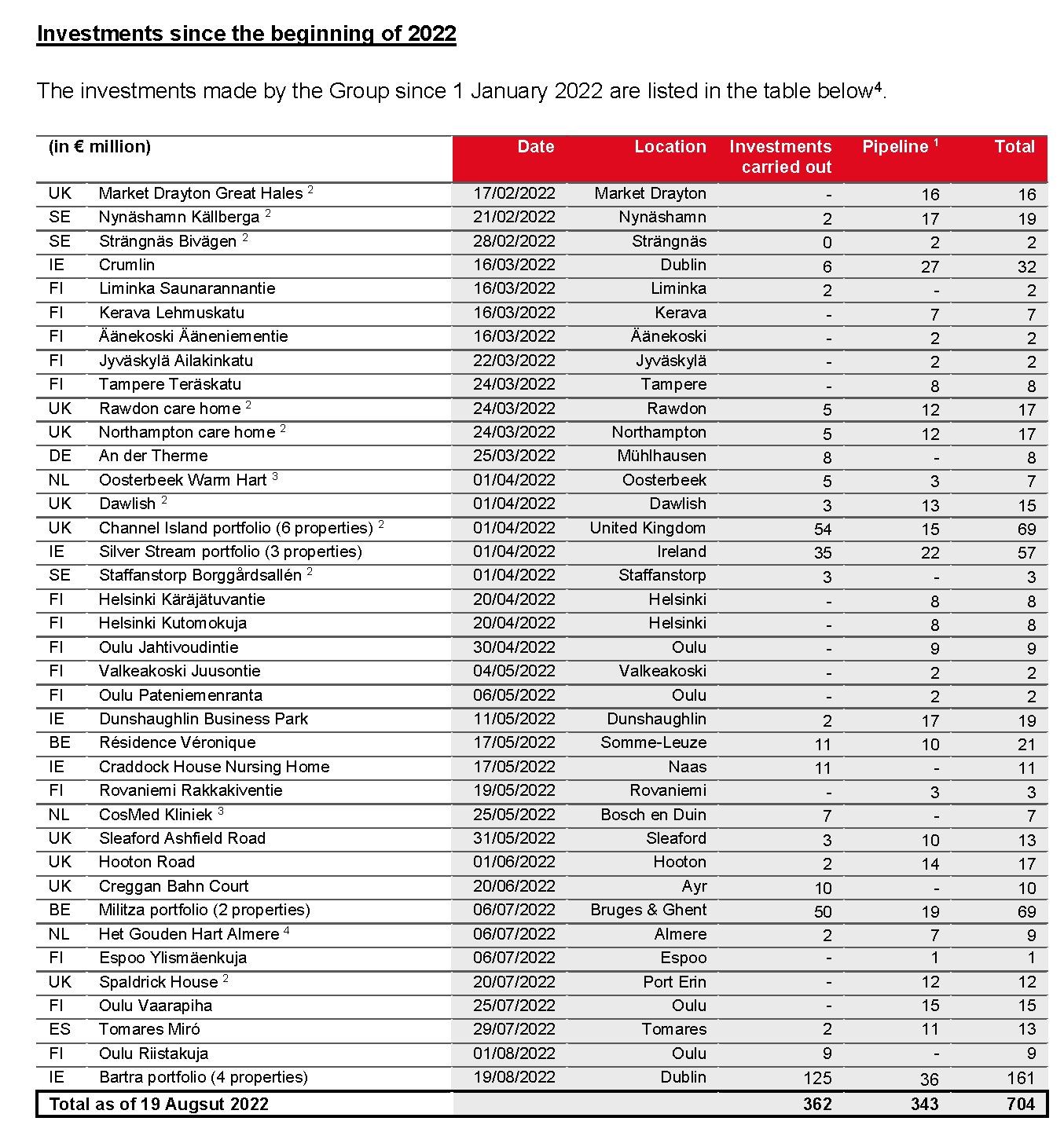

Stefaan Gielens, CEO of Aedifica, stated: “The transaction will further strengthen our position and visibility in the Irish market and contributes immediately to the Group's results. Our portfolio in Ireland will now increase to nearly €460m upon completion of all development projects.”

Gielens added that the care properties will be let on the basis of new irrevocable 25-year triple net leases that are fully indexed to the consumer price index. The initial net rental yield amounts to c.5%.

Aedifica has developed a portfolio of over 600 sites in Belgium, Germany, the Netherlands, the UK, Finland, Sweden, Ireland and Spain, worth more c.€5.3bn. Aedifica is listed on Euronext Brussels and Euronext Amsterdam.

Since March 2020, Aedifica is part of the BEL 20, the leading share index of Euronext Brussels. Aedifica’s market capitalisation is c.€4bn.