Shares in British chip designer Alphawave soared yesterday after a takeover approach from a US rival, writes Hugo Duncan.

The stock jumped 46.5pc - to value it at £1bn (€1.2bn) - after Qualcomm said it was "considering making an offer".

A takeover would be a bitter setback for London as it struggles to attract hi-tech companies and others to the stock market, with many flocking to New York.

Questions have been asked about the City's status as a financial centre of the future since Cambridge-based chip designer Arm opted to list in the US rather than the UK three years ago.

Arm is now valued at some £90bn - which would make it the fifth biggest company in the FTSE 100 behind AstraZeneca, Shell, HSBC and Unilever had it listed in London.

The approach by Qualcomm comes after Arm also looked at making a bid for Alphawave - underlining its value to major players in the industry.

But the company has proved far less loved at home, however, with its shares tumbling 80pc from its peak in 2021 soon after it listed to yesterday before the Qualcomm approach.

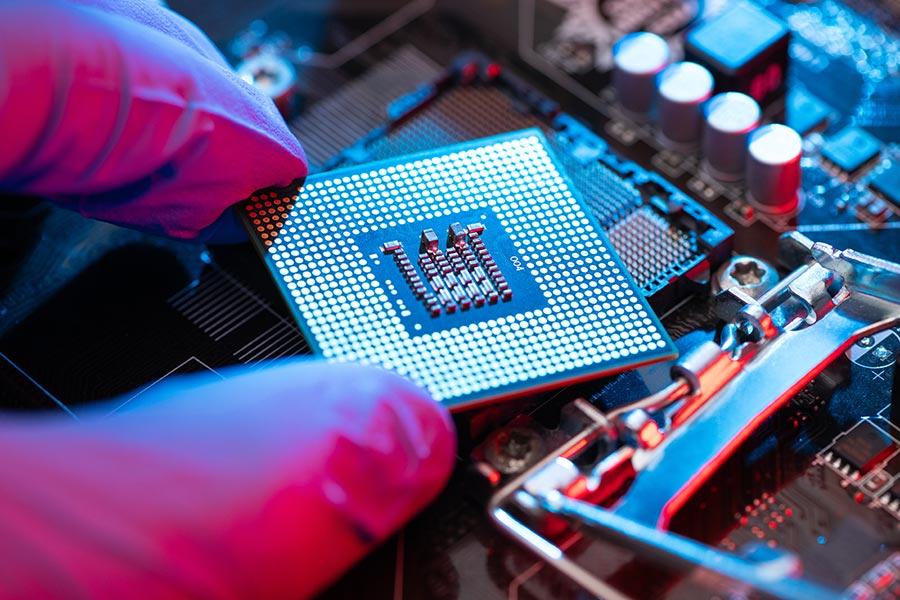

Alphawave designs and licenses semiconductor technology for data centres, networking and storage.

Its "serdes" technology determines how fast information can be processed by chips - crucial for AI development. Under UK takeover rules, San Diego-based Qualcomm now has until April 29 to make a firm offer or walk away.

A spokesman for the US giant said: "There can be no certainty that any firm offer will be made, nor as to the terms on which any firm offer might be made."