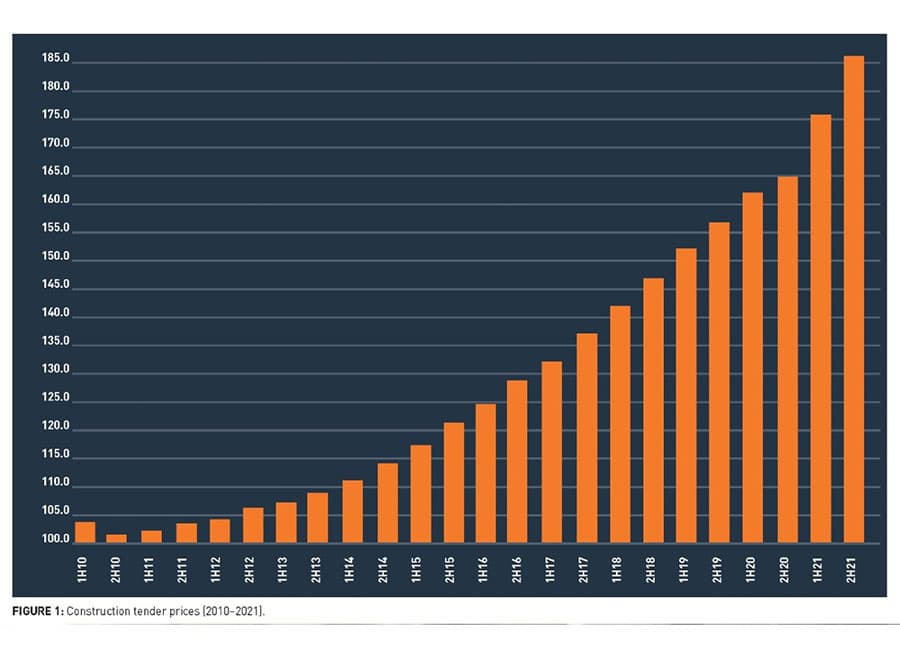

The annual rate of construction price inflation is now running at over 13%, and the war in Ukraine is likely to lead to a further rising this year, according to the Society of Chartered Surveyors Ireland.

The organisation's latest tender price index shows inflation in the sector last year amounted to 13.4%, up from 8.3% the previous year when building sites were beset by Covid-enforced closures.

The figures indicate significant variation across the regions during the second half of the year, with the highest rate of inflation (8%) being recorded in the rest of Leinster, while Connacht-Ulster measured the lowest rate (4%), and both Dublin and Munster saw inflation of 6%.

Kevin Brady, chair of the SCSI's quantity surveying group, said inflation was rising at a time when commercial construction activity is at "exceptionally high levels" across the country, and also in part due to labour shortages following the lifting of restrictions.

"The main reasons for current price inflation are high price volatility across a range of building materials - particularly insulation, cement, plasterboard metals and fuel - labour shortages and the extremely high demand for projects across all tiers as the industry continues to readjust in the wake of the covid crisis," Brady said.

Brady went on to say that the war in Ukraine was affecting the cost of materials previously sourced in the region such as steel and base metals while also leading to a dramatic increase in fuel and energy costs.

"This is a huge concern for all within the building trade, but we will have to wait until our next survey is out in mid-summer to capture the inflationary effect the war has had on construction costs," he continued.

“Other factors that we expect to contribute to the inflation rate in the first half of 2022 will be labour cost increases following the implementation of the Sectoral Employment Order which came into effect on 1 February.

"This sets the statutory minimum rates of pay and other conditions (sick pay and pension entitlements) for persons employed in the construction sector. This has applied increases of pay across construction trades and it is expected that the tender price index will also see some impact of this in our next report.”

Kevin James, vice president of the SCSI, agreed that the rate of material price increases would continue to rise this year, "with the scale of increase very much dependent on the duration and outcome of the war. The body's tender price report, published in October, had forecast that price inflation would ease in 2022 as restrictions were stripped back.

"Our members who are employed by contractors, public sector and consultancy firms report that there is a nervousness in the sector at present especially when tendering for new contracts," James said.

They say developers and contractors are taking a more conservative approach to risk when negotiating construction contracts.”

“Management of risk has now become a primary focus for companies to ensure that construction competitions awarded are adequately structured to protect against inflation pressures within the market.

"Some contracting firms are no longer accepting previous contract risks due to material inflation and are either delaying jobs or selecting jobs where the client is taking on the risk. This is particularly apparent in the private sector.”

James called on the government to introduce additional measures in the public sector builds to ensure that existing projects are afforded an equitable level of price variation, enabling contracts to respond to price increases and ensuring a more balanced price risk.

"Recent changes to new contracts were welcomed by the sector when covid led to higher inflation rates, and the SCSI is calling on similar supports to be introduced now to counter the impact of inflation due to high energy costs," he added.

"While we have little or no control over global issues, we would urge government as it prepares for Budget 2023 to focus on solutions to reduce costs by refocusing efforts to address planning permission issues and improve public procurement procedures.

"For its part, the industry will have to step up its cost benefit analysis of materials, utilise modern methods of construction, identify innovative cost saving solutions and streamline pre-construction periods to minimise the impact of inflation.”

(Pic: Getty Images)