Ireland’s headline inflation rate dropped back into negative figures in September, after zero movement in August, according to the latest data furnished by the CSO.

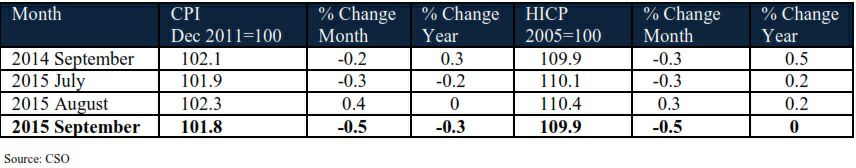

Prices were down 0.5% in September, giving a headline annual inflation rate of -0.3%, compared with zero in August and -0.2% in July.

Commenting on the figures, Alan McQuaid of Merrion Stockbrokers noted that the headline inflation rate has been negative for nine of the last ten months.

“Meanwhile, the HICP rate, the measure used for EU comparative purposes, was also down 0.5% in the month, giving an annual inflation rate of zero on this basis, down from 0.2% in the two previous months,” he added.

The main monthly changes affecting the CPI in September were decreases in the price of petrol, diesel and airfares.

Said McQuaid: “The cost of hotel accommodation was also lower in the month. However, motor and health insurance premiums were higher than in August, as was the cost of clothing and footwear, suggesting that the overall benefit to consumers may not be as strong as the headline CPI suggests.”

McQuaid maintained that, despite the strong Irish economy, inflationary pressures were likely to remain fairly well contained in the immediate future, mainly because of lower oil prices. “But the cost of services like insurance look set to continue to rise.”

Oil prices will be critical will be critical in determining the headline inflation outlook over the next 12 months or so, according to McQuaid.

“Oil is facing the heat on several fronts. Perhaps the most important of them pertains to the mounting worries about China’s crude demand.

“In particular, the Asian giant’s currency devaluation has stoked speculation about soft economic growth in the world’s number two energy consumer.

“What’s more, in the absence of production cuts from OPEC, the effects of booming shale supplies in North America and a stagnant European economy, not much upside is expected in oil prices in the near-term.”

McQuaid continued: “Low inflation in Euroland will mean easier ECB monetary policy being in place for longer, which should be good news for consumers, though whether it feeds through into lower variable mortgage rates here remains debatable.”