In a budget proverbially lauded as the ‘cost-of-living budget’, it is no surprise that packages aimed at putting money in the pockets of citizens - either through cash payments, grants or tax breaks - are high on the agenda.

From the freeing up of €300 million in COVID support money, or the utilisation of unexpected tax receipts, said to be almost €50 billion, the government is spending big to try and appease disgruntled voters left out of pocket by rampant inflation.

Minister for Finance Paschal Donohoe stated that inflation is forecast to be 8.5% in 2022 and 7% in 2023, with non-energy 'core' inflation registering at 5.25% for 2022 and 4.5% in 2023.

Dononohe said that the government's aim with the budget is to "strike a delicate balance between helping with the cost of living" and "not making them worse by adding fuel to the inflationary fire".

Donohoe said that the budget will be worth €4.1 billion in once-off cost of living payments in 2022, and €6.9 billion in 2023, with the base budget worth over €11 billion overall.

The cost-of-living measures in Budget 2023 are as follows:

Energy

Perhaps the biggest talking point in the cost-of-living crisis, runaway energy prices are proving to be a major headache for household and business consumers.

As opposed to a cap on energy prices, the government is instead introducing a €600 deduction on energy bills for households, spread over three bills. The first bill will be before Christmas

SMEs will also be able to avail of universal support towards their energy bills through the Temporary Business Energy Support Scheme (TBESS).

It will operate on a self-assessment basis, and will compare the energy bills between 2021 and 2022 - if bills have increased by 50%, a business is eligible, and will see 40% difference being paid back, up to €10,000.

Welfare

Those on social welfare will be the subject of a number of extra payments, as well as a small increase in the basic rate of payment.

A one-off double payment of the Child Benefit Allowance will be paid in November, as will a double ‘cost-of-living’ payment for all social welfare recipients in October.

There have been discussions over the increase in the baseline social welfare payment, but it has been agreed at a rate of €12, following negotiations of rates between €10 and €15.

A €500 lump sum payment for those on the working family payment.

A €500 payment for people on carer's support grant.

A €500 lump sum payment for those on disability allowance, invalidity pension and the blind pension in November.

The home carer tax credit has increased by €100.

A €400 fuel allowance payment to be paid by Christmas, while the qualifying income threshold for the fuel allowance will rise from €120 to €200, and over 70s will see their fuel allowance increase to €500 for singles or €1000 for couples.

€200 will be paid to those on the living alone allowance.

Minister for Public Expenditure Michael McGrath said that a "a single pensioner, living alone, in receipt of Fuel Allowance will receive an additional €2,375 between now and the end of 2023" as a result of the payments.

Childcare

Parents have received another boost, with extra-budgetary support being allocated towards childcare costs. Fees will be cut by up to 25%, with the base subsidy rate jumping nearly a euro from 50 cent to €1.40 an hour, with potential average monthly savings of €175 per family.

The childcare budget for next year will reach €1 billion.

Education

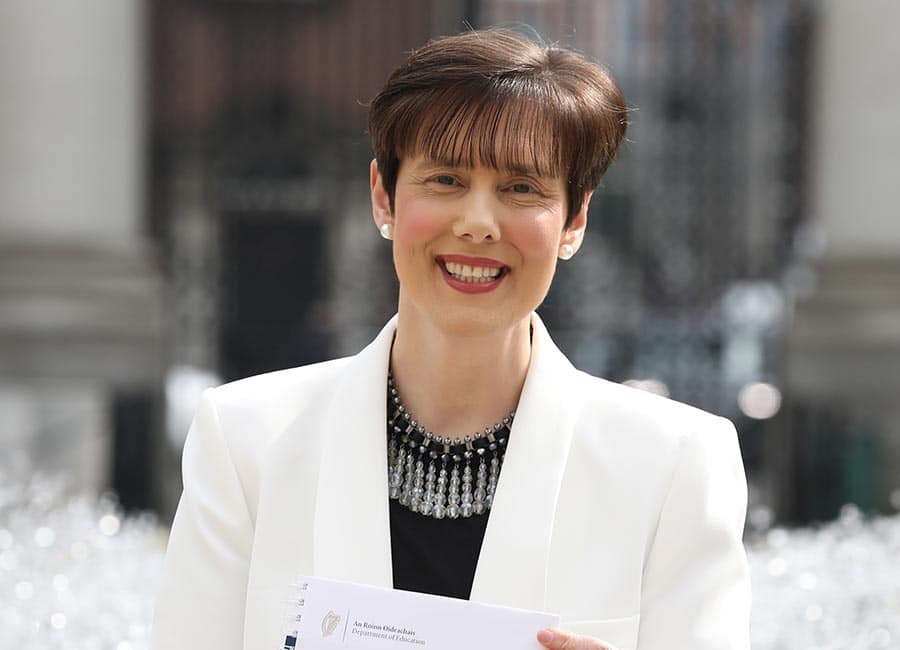

Norma Foley secured a coup with the provision of free textbooks for primary school students from next year, at a cost of €47 million, while an extra €10 million has been secured for the school bus scheme.

€1000 once-off reduction in college fees for eligible third-level students, while there will be an extra double payment for SUSI grant recipients.

The post graduate tuition fee contribution fee will increase by €1000.

All SUSI grants will increase by 10-14% from next year, while the student contribution for college fees will drop by €500 permanently.

The threshold for a 50% reduction in college fees under SUSI will increase from €55,240 to €62,000.

Housing

The help-to-buy scheme is being continued until 2024, while a rent allowance tax credit is being introduced - with €500 being permitted this year and €500 in subsequent years.

Pre-letting expenses for landlords are being increased to €10,000 while the timeframe for vacant houses has been reduced from 12 months to 6.

Tax

The headline tax change is the increase of the 40% tax rate to €40,000 - an increase of €3,200.

The main tax credit has increased by €75, while the 2% USC rate has increased from €21,295 to €22,920.

Misc

Free GP care has been extended to 400,000 people, with services extended to 6- & 7-year-olds.

The 20% transportation rate reduction has been continued, alongside the 50% youth travel card.

Expansion of free contraception to all women from age 16-30; publicly funded IVF treatments to start from September 2023.