A new law brought before the Dáil yesterday would protect family farms from vulture funds.

The Rural Independent Group has teamed up with the master of the High Court Edmund Honohan to put together the Impaired Farm Credit Bill 2022.

The Bill will aim to protect family farms from vulture, or distressed debt, funds but, they claim, will provide low-interest credit for farmers.

The Private Members Bill was sponsored by the six TD members of the Rural Independent Group. They said in a statement that the Bill had been "carefully crafted, on their behalf, by the master of the High Court". The Bill passed the first stage of becoming law in the Dáil yesterday, but it will need cross-party support to get onto the statute books.

The rural group said that the Bill would set up a State-run institution that would provide low-interest credit to all agricultural operations in a specialised manner. It would allow access to capital and credit in rural Ireland.

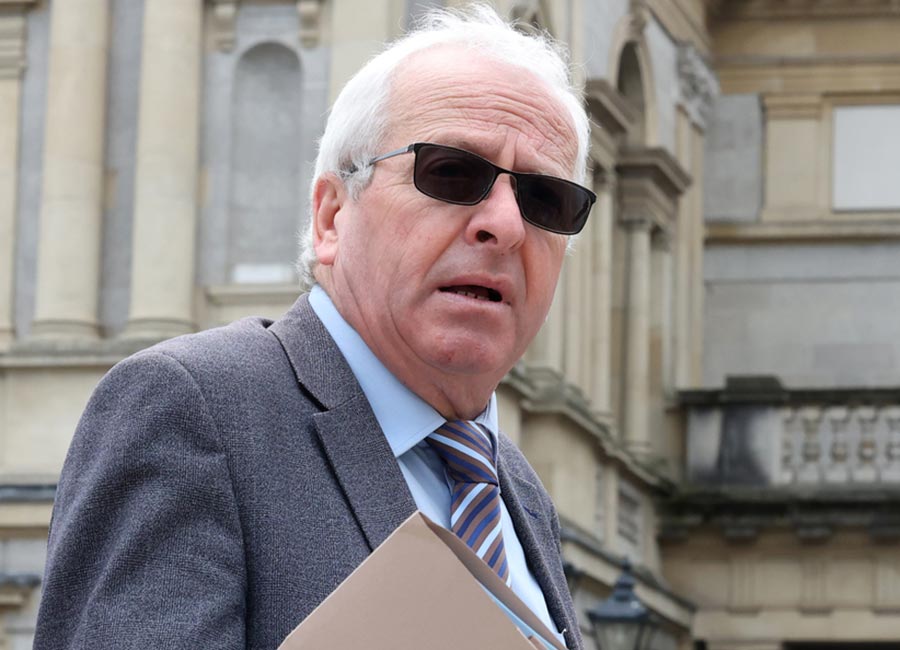

The leader of the Rural Independent Group, Deputy Mattie McGrath asserted at the Bill's launch yesterday: "For too long the Government have facilitated vulture funds and banks to seize and sell family farms in Ireland. This Bill would create a policy platform to tip the scales back in favour of landowners and farmers and is all about protecting the small man or woman against predatory financial institutions."

The rural group said that the agri-food sector is of systemic importance to the economy and is generating €14.4billion a year.

"Furthermore, the sector employs one in every ten workers in the State," said Mr McGrath.

"The Government are targeting deep cuts to farmers' ability to earn a living through climate action reductions and an inadequate new CAP programme."

Mr McGrath claimed that banks and vulture funds who purchased impaired loans are now targeting farmland and family homes.

"We have observed first-hand the destruction and crippling impacts that these forfeitures have caused to families and rural communities. That is why we have brought forward this imaginative new Bill," he said.