The Securities and Exchange Commission has charged Allianz Global Investors U.S. LLC and three former senior portfolio managers with a massive fraudulent scheme that concealed the immense downside risks of a complex options trading strategy they called ‘Structured Alpha’.

The US regulator said AGI US marketed and sold the strategy to 114 institutional investors, including pension funds for teachers, clergy, bus drivers, engineers, and other individuals.

After the COVID-19 market crash of March 2020 exposed the fraudulent scheme, the strategy lost billions of dollars as a result of AGI US and the portfolio managers’ misconduct.

According to the SEC, AGI US has agreed to pay billions of dollars as part of an integrated, global resolution, including more than $1 billion to settle SEC charges and together with its parent, Allianz SE, over $5 billion in restitution to victims.

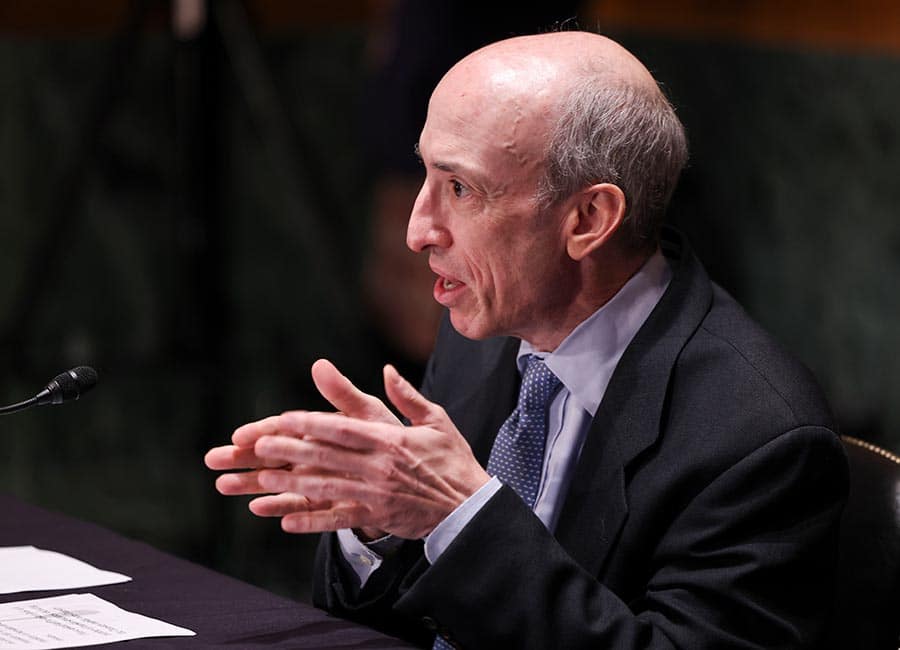

SEC chair Gary Gensler stated: "Allianz Global Investors admitted to defrauding investors over multiple years, concealing losses and downside risks of a complex strategy, and failing to implement key risk controls.

"This case once again demonstrates that even the most sophisticated institutional investors like pension funds can become victims of wrongdoing. Unfortunately, we’ve seen a recent string of cases in which derivatives and complex products have harmed investors across market sectors.”

The SEC’s complaint, filed in the federal district court in Manhattan, alleges that three Structured Alpha portfolio managers manipulated numerous financial reports and other information provided to investors to conceal the magnitude of Structured Alpha’s true risk and the funds’ actual performance.

Performance smoothing

The SEC cited evidence that the defendants reduced losses under a market crash scenario in one risk report sent to investors from negative 42.1505489755747% to negative 4.1505489755747% by simply dropping the single digit 2.

In another example, defendants ‘smoothed' performance data sent to investors by reducing losses on one day from negative 18.2607085709004% to negative 9.2607085709004% - this time by cutting the number 18 in half.

When the 2020 Covid-related market volatility revealed that AGI US and the defendants had misled investors about the fund’s level of risk, the fund suffered catastrophic losses and investors lost billions.

The SEC complaint further alleges that defendants in the proceedings made multiple ultimately unsuccessful efforts to conceal their misconduct from the SEC, including false testimony and meetings in vacant construction sites to discuss sending their assets overseas.

Gurbir S. Grewal, director of the SEC’s Division of Enforcement, commented: "From at least January 2016 through March 2020, the defendants lied about nearly every aspect of a highly complex investment strategy they marketed to institutional investors.

“While they were able to solicit over $11 billion in investments by the end of 2019 and earn over $550 million in fees as a result of their lies, they lost over $5 billion in investor funds when the market volatility of March 2020 exposed the true risk of their products.

"Following the crash of the Structured Alpha funds, the defendants continued their pattern of deceit by lying to SEC staff and their fraud would have gone undetected if it weren’t for the persistence of SEC lawyers who pieced together the full scope of the massive fraud."

AGI US admitted that its conduct violated the federal securities laws and agreed to a cease-and-desist order, a censure and payment of $315 million in disgorgement, $34 million in prejudgment interest, and a $675 million civil penalty, a portion of which will be distributed to certain investors.

Photo: SEC chair Gary Gensler. (Pic: Getty Images),