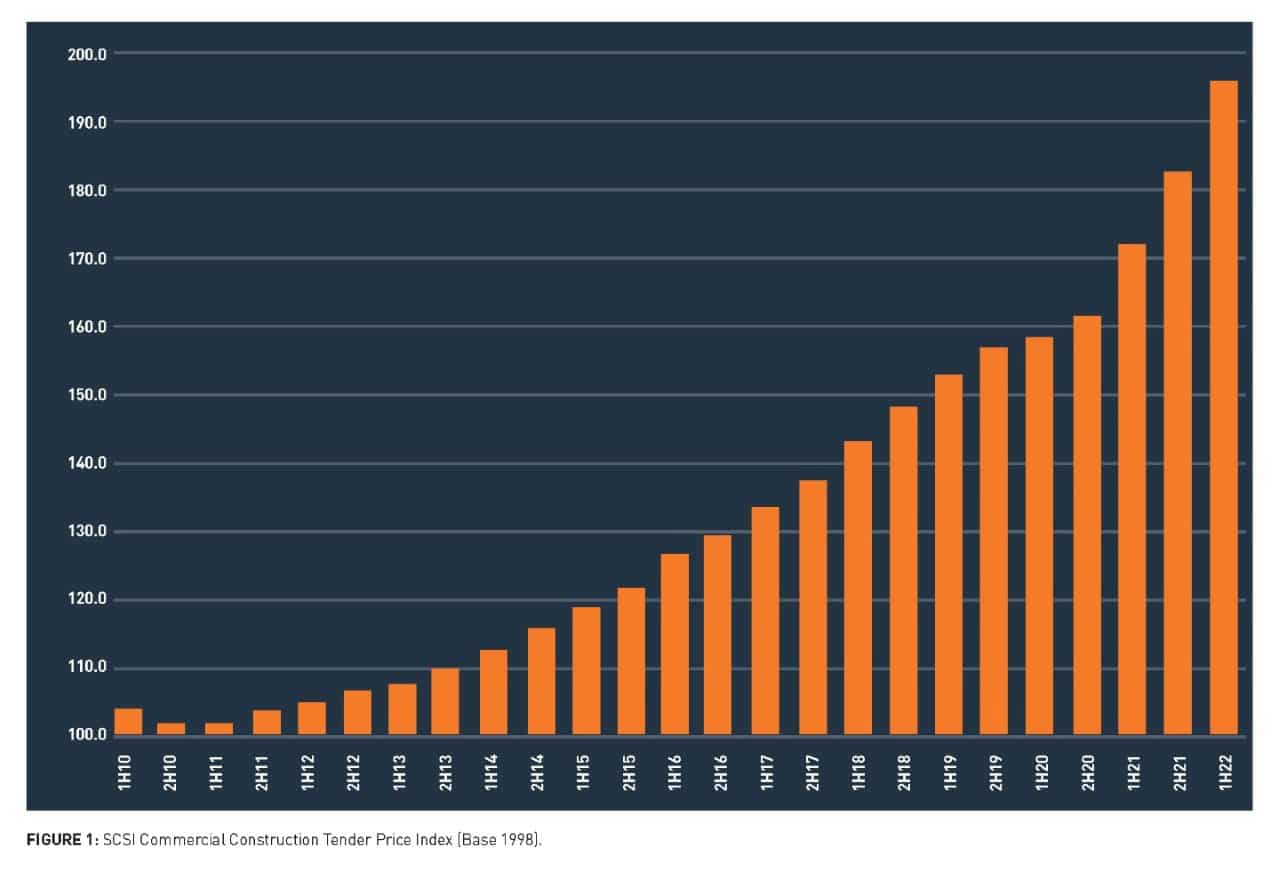

Inflation in construction cost has surpassed peaks recorded during the Celtic Tiger era with prices increasing 7.5% during the first half of the year, according to the Society of Chartered Surveyors (SCSI).

The SCSI said inflation for input prices is now running at 14%, up from 13.4%, and blamed Covid lockdowns, supply chain shocks and the war in Ukraine for tender price inflation of 22% over the past 18 months.

The 7.5% six-month inflation figure is the highest recorded by the SCSI since it started tracking construction inflation in 1998, beating the 7.4% recorded in the second half of 2000, and the report indicates inflation of 7% in Dublin and 8% across the rest of the country.

"During the last six months we’ve recorded the highest ever rate of construction inflation increase since we began tracking it 24 years ago. This is largely due to the impact of the war in Ukraine, which is causing high energy prices and exacerbating the inflationary pressures on construction materials," said Kevin Brady, chair of the SCSI's quantity surveying professional group.

"In the previous six months the main issue was material price volatility due to supply chain issues while during the first half of 2021 it was pent-up demand for construction services as we emerged from covid lockdown.

"In addition to these external issues, high demand over the last year and a half has been compounded by severe labour shortages and rising labour costs. As the sector struggled to deal with this series of unprecedented events, construction inflation has risen by a record 22% over the last 18 months.”

“These are significant increases, and their continuous nature is adding tremendous pressure on the sector in terms of viability for projects. It had been anticipated that the increases we saw in the second half of last year following the reopening of the industry after covid restrictions would stabilise as supply chains and demand adjusted in the first half of this year. However, the war in Ukraine has continued and has resulted in a sustained rise in inflation.”

Brady added that the products that have increased most in price include insulation, plasterboard and sanitaryware, and the price of timber products, including softwoods, OSB boards and plywood, is beginning to level off, while the price of rebar – steel used in reinforced concrete and copper - is down.

SCSI president Kevin James said it was "extremely challenging" to accurately predict future tender rates given the current market conditions and geopolitical conditions, but that chartered quantity surveyors expect prices to increase at slower rate during the second half of 2022.

James also urged the government to take action now that prices had surpassed Celtic Tiger levels, with members now complaining about the affordability and viability of projects.

"Commitments by government to reform planning procedures is welcomed by the SCSI. The SCSI believes Government should reduce overall levels of risk and costs of delivery where they can such as reducing planning delays and timelines," he said.

James went onto say that the industry is at near-peak capacity, but that an economic downturn could lead to capacity coming back to the market, which could in turn lead to reduction in the pipeline of work and encourage more competitive tendering.

The SCSI also cautioned government against introducing further taxation on commercial property transactions, and that although the construction sector had been bolstered by new industrial and logistical developments, retail and office types had seen declines due to Covid.

"In Budget 2020 stamp duty on commercial transactions was increased to 7.5%. We’re calling on Government to refrain from further increases, as such interventions cause uncertainty in the market and act as a deterrent to investment. In the current environment we don’t need further uncertainty” James concluded.