Chipmaker Nvidia yesterday elbowed aside Microsoft as the world's biggest company after it shrugged off tariff woes to post bumper results, writes Jessica Clark.

Shares in the US tech giant surged 6.2pc when Wall Street opened after it reported quarterly sales rocketed nearly 70pc.

Microsoft also rose - by 0.2pc - giving it a market capitalisation of €3 trillion. But that was not enough to hold on to top spot as Nvidia's valuation hit €3.05 trillion after it climbed €162bn following the publication of its results on Wednesday.

Nvidia shares hit $143.49, enough to overtake Bill Gates' firm despite being caught in the fallout of Donald Trump's trade war with China.

Microsoft later nudged ahead of Nvidia during choppy trading as Nvidia shares fell back to $139.18.

Nvidia said revenue rose 69pc from €22.94bn to €38.8bn for the three months to April 27. Net income was €17.6bn - 33pc more than the €13.43bn a year ago.

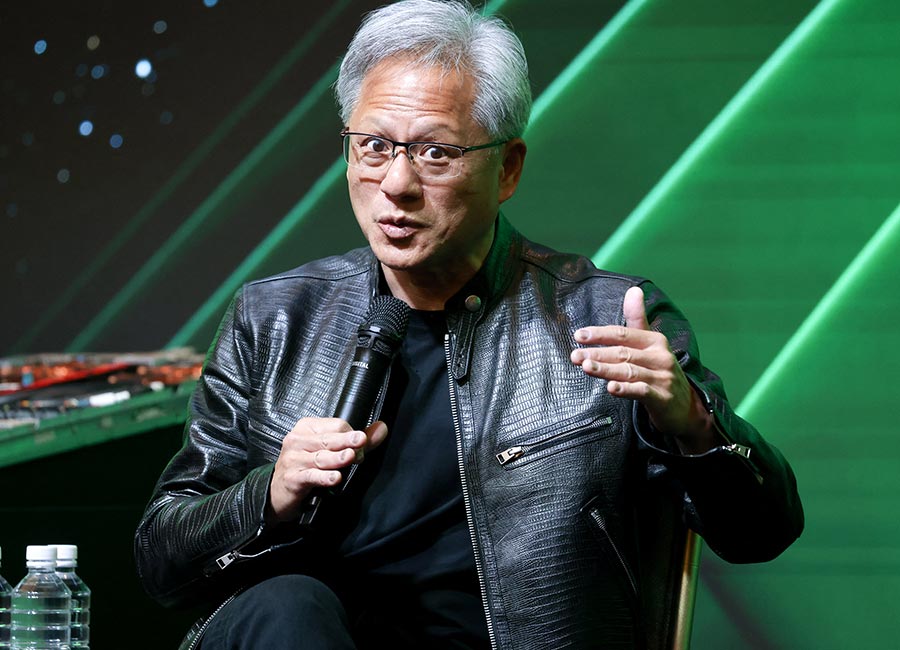

Chief executive Jensen Huang attacked Trump's ban on sales of Nvidia's most powerful chips to China, saying it would "strengthen" Chinese competitors.

"The US has based its policy on the assumption that China cannot make AI chips. That assumption was always questionable and now it's clearly wrong", he said.

"Export controls should strengthen US platforms, not drive half of the world's AI talent to rivals."

He added: "The platform that wins the AI developers wins AI." But he said the President had "a bold vision to reshore advanced manufacturing, create jobs and strengthen national security".

"He has a vision and I trust him," Huang said. Nvidia replaced Apple as the world's largest company in January this year and in 2024.

The iPhone maker is now third, behind Microsoft and Nvidia, with a market capitalisation of €2.6trillion.

The US market was higher overall yesterday after a bombshell ruling that raised questions over Trump's tariff strategy.

A judgment from the US Court of International Trade threw doubt on whether the 10pc universal tariff will stick and whether levies will be implemented in July.

In a blow to the President, the court said he exceeded his authority in imposing skyhigh tariffs on trading partners.

The case could eventually end up in the US Supreme Court, causing further delays and uncertainty for global markets.

'Just when traders thought they'd seen every twist in the saga, the gavel dropped like a lightning bolt over the Pacific,' said trader Stephen Innes of SPI Asset Management. The ruling was 'a brief respite before the next thunderclap,' he added.