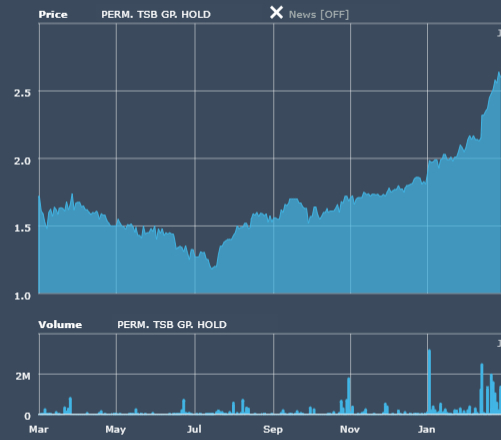

Permanent TSB is claiming mortgage market share of 18.5% after advancing €2.6bn of new mortgage lending in 2022, an increase of 40%.

Net interest income for 2022 was €362m compared with €313m the year before, with additional income of €42m from fees and commissions.

Operating profit excluding exceptionals was c.€10m as the bank’s overheads continued to expand.

PTSB’s annual report discloses that costs associated with buying assets from Ulster Bank were €92m in 2022 after €28m in 2021, for a total of €120m.

The Ulster Bank deal closed in November 2022 when €5.2bn of the vendor's retail business assets and processes were acquired by PTSB.

The bank’s transaction outlay was €4,816m in cash, 91m PTSB shares valued at €155m, and €37m contingent, for a total consideration of €5,008m.

In return PTSB acquired retail mortgage lending with a value of €5,386m and 25 new branch locations.

PTSB’s accounts in the 2022 annual report record a €362m exceptional gain on what’s described as a ‘bargain purchase’. With this is included, the bank’s net profit for the year was €223m.

PTSB said c.250 former Ulster Bank employees have transferred over, with end-year employment counted at 2,614 compared with 2,236 a year earlier.

In February 2023 PTSB completed the migration of the performing micro-SME portfolio of c. €165m and c. 3,200 customer relationships. The acquisition of other Ulster Bank mortgage and asset finance portfolios is due to complete in H1 2023.

Chief executive Eamonn Crowley stated: “We have become a bigger bank, with an expanded branch presence throughout Ireland; an even stronger competitor, with many more personal and SME customers; a larger employer; and an organisation that is well positioned to build on the exceptional momentum we have generated.

“In an unprecedented era of switching activity, we opened over 160,000 new accounts in 2022, with our award winning digital current account offering, our customer-friendly app and our availability in-person and through our digital and mobile channels making it easier for customers to navigate the transition.

“And we made major progress in scaling up our SME offering through a mixture of organic growth and the Ulster Bank acquisition, as we make our plan for €1bn in new SME lending over three years a reality.”

Crowley added: “Despite a challenging economic backdrop, we approach the remainder of the year and beyond with confidence. We see immense opportunity in the Irish retail and SME market and will continue to bring real competition to the market in the years ahead.”