The total number of claim applications received by the Personal Injuries Assessment Board (PIAB) in 2021 fell by 16% to 26,000, primarily be as a result of the impacts of Covid-19, according to the organisation’s annual report.

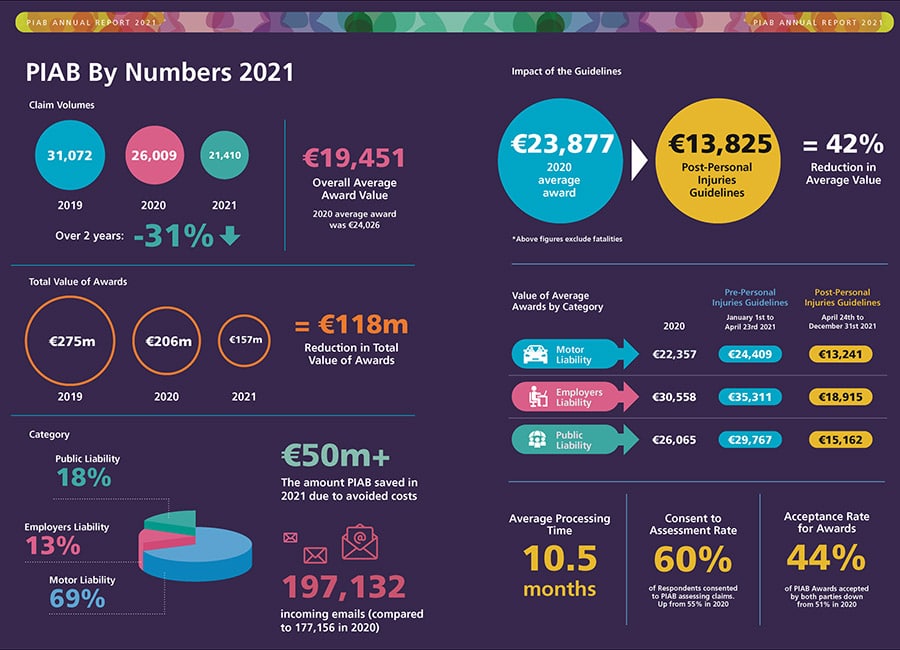

PIAB dealt with 21,410 personal injury claims and awarded total compensation of €157m to accident victims in 2021.

PIAB estimates that €50m in legal and other costs had been avoided last year due to its existence as an alternative to litigation.

The average PIAB award made after April 2021, when new guidelines came into force, was €13,800, compared to €23,900 in the previous year, with 69% of awards related to motor claims, 18% to public liability, and 13% to employer liability.

The decrease in volumes and values of claims is reflective of all categories of claims, with motor claim applications down by 31%, public liability down by 27%, and employer liability down by 28%.

The number of claims involving fatal injuries has also reduced from 121 to 84, and neck and back injuries are the most common injuries, making up 50% of motor claim injuries, with 90% of these being classified as minor soft tissue injuries.

"2021 has been a hugely significant year for PIAB. The introduction of the guidelines has been the single biggest change in the personal injuries area since PIAB was first established 18 years ago," said Rosalind Carroll, CEO of PIAB.

"While there are very immediate impacts in terms of award values, it will take time to see the full impact in terms of reducing the amount of personal injuries litigation. In the interim, the very significant shift in both volume and award values must not be ignored. The total value of awards that PIAB assessed in 2021 was €118m less than in 2019.

"This shows major savings that will likely be mirrored outside of the PIAB system, which should translate into meaningful reductions in insurance premiums for consumers and businesses paying for cover.”

Minister of State with responsibility for PIAB Robert Troy said increasing the number of personal injury claims settled through PIAB is a priority for him, and that he would shortly publish a bill to strengthen the board and allow it to resolve more claims.

"Our report this year has shown that resolution of claims through PIAB services saved approximately €50m in additional claim costs last year that would otherwise have been spent on legal and other costs. There is a huge opportunity for PIAB to contribute much more than this, and for less cases to go to litigation," said Dermot Divilly, chair of PIAB.

“The benefits of our service matter for everyone who makes a claim, seeks cover or pays premiums. PIAB can offer an impartial, independent assessment of claims on the same basis as the courts but with significantly reduced costs and time."

Insurers' reaction

Moyagh Murdock, CEO, Insurance Ireland, said insurance companies are encouraged by the figures published by PIAB and “greatly appreciate PIAB’s commitment to the new guidelines”.

Murdock added: “While pricing is a matter for individual companies and competition law prevents us from commenting on future pricing in the market, CSO data shows that motor premiums have reduced by 42% since the peak in August 2016.”

A Central Bank report earlier this year found that in the 2020 reporting period, only 11% of cases were settled through PIAB, with 65% settled through litigation.

“We are encouraged by two important High Court cases reaffirming the new guidelines, but we must emphasise the importance of the courts consistently applying the guidelines if we are to see a reduction in the cost of claims from litigation fees. As PIAB’s report shows, the acceptance rate for awards decreased from 51% in 2020 to 44% in 2021,” Murdock added.

Insurance Ireland contends that there is a minimal difference for most cases in final award levels settled via PIAB versus those awards settled via the courts.

“The worry with the lower acceptance rate is that more cases will go to litigation for little additional benefit to the claimant but ultimately at a higher cost to the consumer. For the success of the insurance reform agenda in Ireland and the credibility of the Personal Injury Guidelines, it will be essential that the cases are heard expeditiously and that the Courts reaffirm the guidelines in their procedures.”

Insurance Ireland has advocated for the strengthening of the powers of PIAB as a means of reducing legal costs in the claims settlement process.

(Pic: Getty Images)