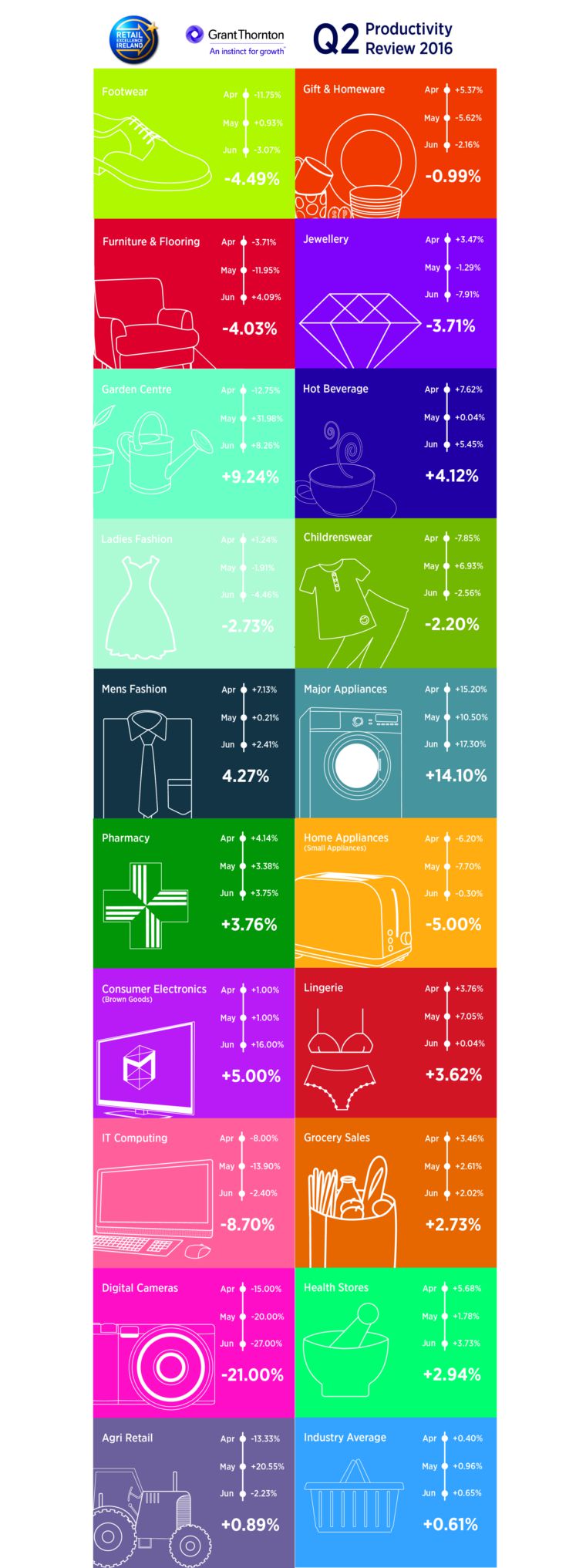

Retail sales in the second quarter continued to flatline, with some sectors performing well and others showing sharp falls, according to the latest retail productivity review from Grant Thornton.

Some sectors performed well, while others experienced like for like declines. The clement spell of weather in late May and early June helped agriculture and garden, which saw over 9% growth. Fashion and footwear declined, in women’s and children’s wear as well as jewellery.

Some home categories performed reasonably well, with growth in large home appliances of 14% and gifts and homewares also up. Furniture and flooring, though, showed a decline of 4% despite sustained growth over the previous three quarters. The impact of Ireland’s political instability and the Brexit decision contributed to a disappointing quarter overall, said Grant Thornton.

Lynn Drumgoole of Retail Excellence Ireland said: “There were winners and losers across the Quarter 2 period and weather and politics played significant roles. A most definite concern is the reduction in growth rates across a number of sectors in the industry and an overall flat quarter after the lift of Q1.

“While political instability and Brexit have had and continue to have a significant impact on trading, a greater concern is that underlying consumer confidence is eroding. It is for that reason that we need a real political focus on the needs of the domestic economy and the full implementation of the promised Employers PRSI reduction for low paid workers to enable employers sustain the minimum wage increase of €0.50 per hour since January 2016 and a further likely increase of €0.10 in January 2017.”

Damian Gleeson of Grant Thornton said: “The Q2 figures clearly demonstrate that it is time for government to step up to the plate. With industry growth rates flatlining, the upcoming budget represents a good time to put some cash back into consumer pockets and help alleviate the negative impact of early year domestic political uncertainty and, more recently, Brexit.

“It also gives government an opportunity to assist employers who, having been battered by eight years of recession, are looking at further increases in the minimum wage. A reduction in employers PRSI is necessary in order to counteract the minimum wage increase or we will see further business failure.”

Grant Thornton conducted the research for the survey on behalf of Retail Excellence Ireland, the industry body which counts over 1,650 retail companies among its members.