Stripe has agreed to repurchase shares from current and former staff members in a deal that values the payments company at $91.5bn after achieving profitability for the first time last year.

The tender offer to Stripe employees was agreed after the company generated $1.4tn in payments in 2024, an increase of 38% from 2023 and equivalent to 1.3% of global GDP.

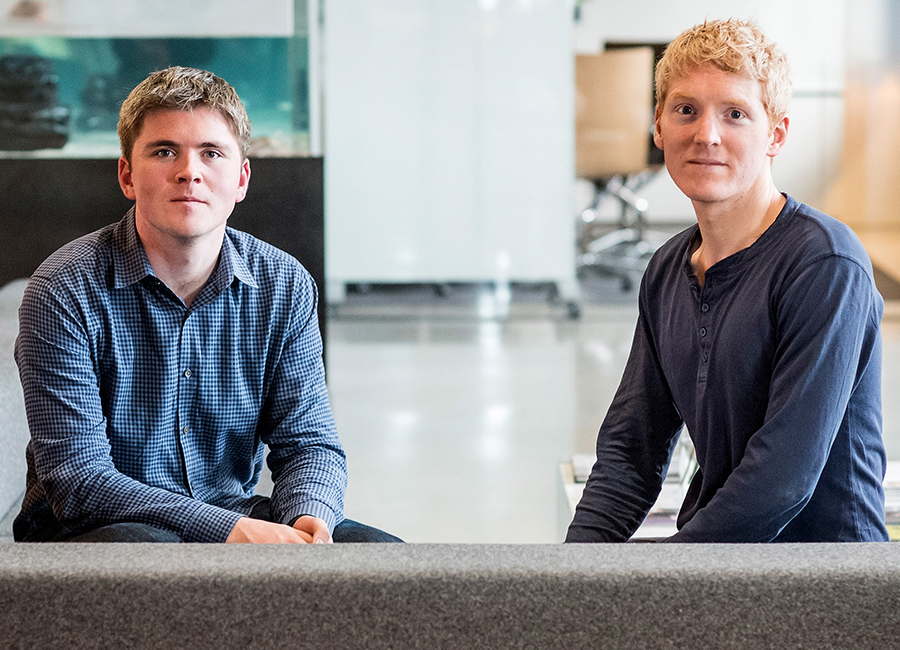

The firm, which was founded by brothers John and Patrick Collison from Limerick, now serves provides payments infrastructure to half of the Fortune 100, and most of the Forbes' Cloud 100 and AI 50.

"Future growth rates will fluctuate (2024 was an unusually good year), but we’re as enthusiastic as ever about the long-term trends in the internet economy," the Collisons said in Stripe's annual letter, crediting the company's machine learning and AI investments.

They said Stripe was profitable in 2024, and that they expect to remain in the black in 2025 and beyond.

"Durable profitability allows us to plow back much of our operating earnings into research and development," they added.

"In each of the last six years, Stripe has reinvested a much higher proportion of our earnings in R&D than any comparable company. We believe this ability will prove particularly important in the coming years, as stablecoins, AI, and other forces reshape the landscape.

"Stripe’s growth to date is evidence of the intense market demand for programmable financial services. The associated transformation is still early."

Stripe's revenue and finance automation suite of products has now passed a $500m revenue run rate, and its Billing product is being used by more than 300,00 companies.

In the letter, Stripe mentioned by name clients such as the University of Oxford, the Church of England, the GAA, Hershey, Pepsi, Comcast, Nvidia, AI search engine Perplexity, Hertz, Turo, Intercom, Forbes, and News Corp.

The $91.5bn valuation returns Stripe close to its peak valuation of $95bn in 2021 after raising $600m in new funding, prior to post-1,100 post-Covid layoffs that laid its valuation as low as $50bn before rebounding to $70bn last year.

Stripe announced 300 lay-offs last month, equivalent to 3.5% of its global workforce, although it plans to grow its headcount from 8,500 to 10,000 by the end of the year.

The unicorn has around 600 staff in Ireland, and completed the $1.1bn acquisition of stablecoin platform Bridge last year.

In the letter, the Collisons described themselves as "proud Europeans" and said that they cannot allow the European economy to continue declining.

"We are proud Europeans, Stripe maintains a headquarters in Ireland (in addition to South San Francisco), and Stripe serves a very large number of businesses across the European continent."

Photo: Patrick and John Collison of Stripe. (Pic: File)