Synch, a new mobile instant payment app devised in 2020 by the major banks, has been given the go-ahead by the Competition and Consumer Protection Commission.

The ambition behind the single mobile payment app is that it will apply to all payment types — to friends, family, retail or e-commerce — and be available to all consumers and businesses in Ireland.

The Synch project was established by AIB, Bank of Ireland, Permanent TSB and KBC, and the CCPC has now cleared the project for implementation, subject to binding conditions.

The four banks will now set up a joint venture company, Synch Payments DAC, to implement their plans.

According to Synch: "The mobile payments service will be available to customers of banks and other financial institutions participating in Synch, which may include the founding shareholders of Synch as well as other banks or financial institutions who decide to join the mobile payments service.

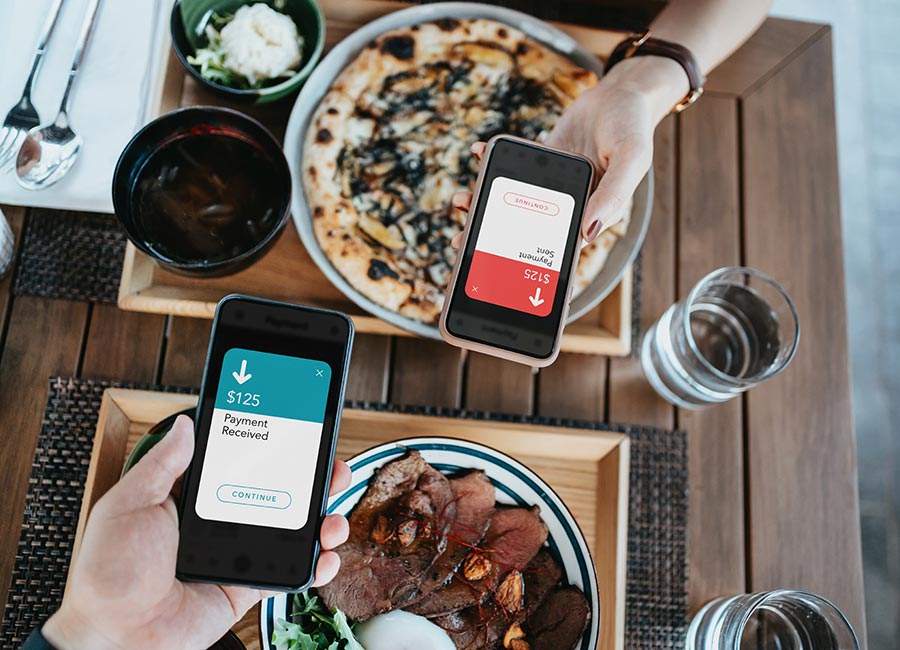

“Through its smartphone app, Synch will facilitate instant person-to-person payments; and instant person-to-business payments services which can be used by online merchants on their websites, or in retail outlets through the use of QR codes, to allow consumers to pay for goods and services.”

Similar types of mobile payments services are already available in many other countries in the European Union.

The CCPC expressed concerns that the banks' joint venture could be a means of foreclosing potential new competitors from entering the market for the provision of banking products and service.

The watchdog was also worried by the possibility that the app would lead to the stifling of innovation in mobile payments services, either through the ability of the founding shareholders to influence decisions regarding future innovation within Synch itself or through a reduced incentive to develop other services.

In response, the banks have agreed that Synch will provide defined timelines for processing new applications and a governance structure with independent directors to allow Synch to operate with a greater level of independence from the founding shareholders.

They also committed to “substantial safeguards to prevent the exchange or disclosure of commercially sensitive information”.

Full annual compliance reports will also be provided to the CCPC.

Synch managing director Inez Cooper said: “The Synch app will revolutionise the mobile payments sector in Ireland, enabling consumers to make instant person to person payments using just their contact details irrespective of who they bank with as well as point of sale and e-commence payments.

“The approval secured today is only the beginning. Already, we have had lots of interest from acquirers, financial institutions and retailers who want to join our open platform. Some institutions and organisations will be there on day one, while others will be added in the weeks and months post launch as we continually grow and evolve our proposition.

“We look forward to licensing many financial institutions, payment service providers, acquirers and retailers and to continually growing the payment ecosystem for the benefit of consumers and businesses in Ireland.”