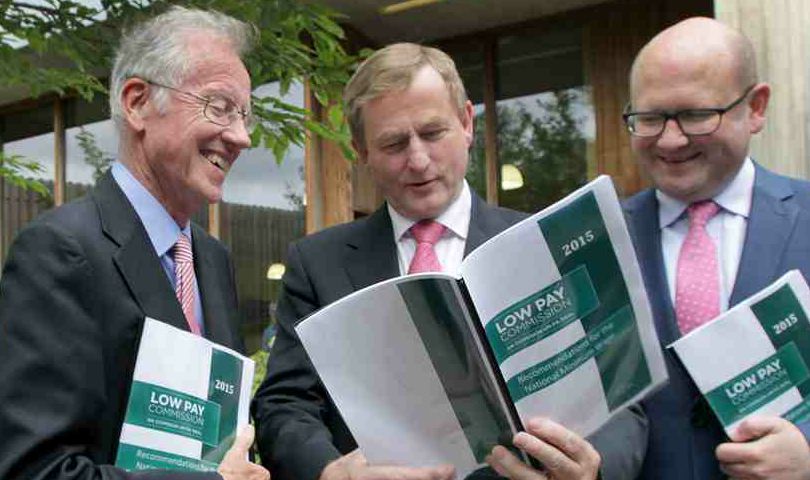

The government looks certain to accept the recommendation of the Low Pay Commission to raise the National Minimum Wage from €8.65 to €9.15 an hour, sometime after Budget 2016 is unveiled in October. Because of the NMW hike, expect the budget to tackle PRSI income thresholds, a move that should benefit all workers.

Though government can decree the level of the NMW, it can’t tell employers how many hours of work a week they have to offer their staff. As things stand, a 39 hour week for a single person on the revised NMW makes no sense at all. That’s because people pay zero PRSI if their income is under €18,300 per annum. Once it goes above that threshold, they pay 4% on the entirety.

A 39 hour week on the new NMW of €9.15 per hour equates to €18,556 per annum. With the 4% PRSI kicking in, the employee is actually one euro worse off in their annual earnings, even though the employer has coughed up an extra €507 in payroll and an extra €1,518 in employer’s PRSI.

Without any amendment in the budget, employers would be better off reducing the working week for NMW staff from 39 hours to 38 hours.

In that scenario, the employee gets an extra €445 in their pay through the year, an increase of 2.6%. There’s a bonus for the employer too, as payroll under €18,512 per annum attracts an employer PRSI rate of 8.5% instead of the standard 10.75%.

A 34-hour week on the new NMW is also relatively tax efficient. In this instance, for a single person with full tax credits their annual income of €16,177 brings them under the threshold when 20% income tax kicks in (€16,500).

For ultra tax-efficiency under the new NMW, the employee works 25 hours a week. At €9.15 an hour, that equates to €11,895 per annum.

At this level, there are no income deductions from the employee for income tax, PRSI or USC.

Expect all these calculations to be revised in October after the budget.