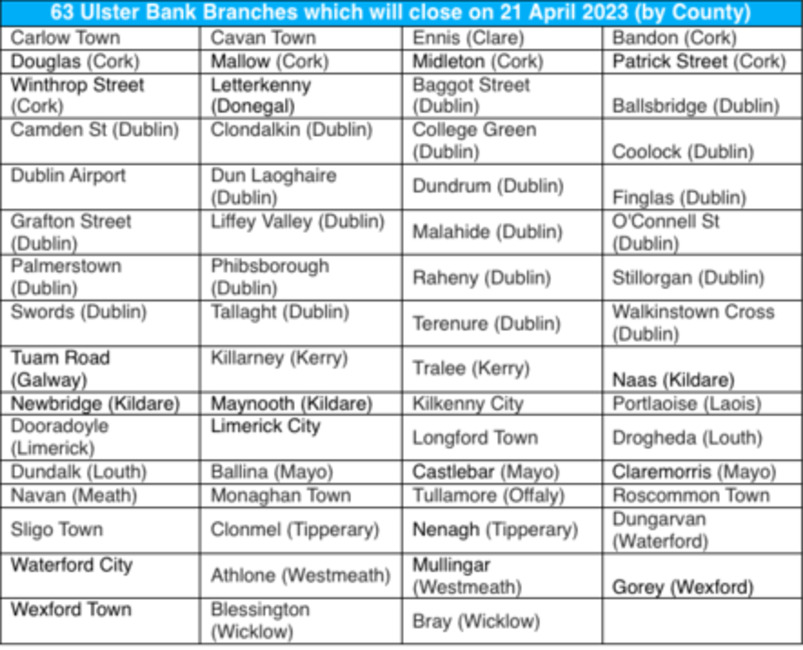

The remaining 63 branches of Ulster Bank will cease transactions at the end of March and close permanently on 21 April as the NatWest-owned lender progresses with plans to exit the Irish market.

Ulster Bank branches will stop processing transactions on 31 March, meaning customers will no longer being able to make cash or cheque lodgements or withdrawals at the counter or at internal automation devices after that date.

ATM services will still be available, however. Ulster Bank customers will also no longer be able to access lodgements or payments through their accounts in An Post post offices after 31 March.

From 1 April to the closure date three weeks later, staff in Ulster Bank branches will be focused on supporting remaining personal and business customers with transferring to a new banking provider and closing their accounts.

There Ulster Bank customer support hub at ulsterbank.ie will remain open, and Ulster Bank's telephone service on 0818 210 260 (or +353 1 804 7475 from aboard) is open from 8am to 8pm seven days a week.

"Today is another significant day in our phased withdrawal as we communicate the closure dates of our remaining branches to colleagues, customers and other stakeholders," said Jane Howard, CEO of Ulster Bank.

"I know that our branches and colleagues have been a central part of these communities for many years and these final months of helping customers to move to new providers will be poignant for all involved. I would like to unreservedly thank all of our colleagues for their continued support of our customers and of each other.

“By the time we close our branches, we know that the closure of current and deposit accounts will have materially concluded. If any customer has not yet moved their current and deposit account, I strongly urge them to act swiftly to find a new provider and move their accounts."

In January, 25 Ulster Bank branches closed down ahead of their reopening under the management of Permanent TSB. A number of Ulster Bank has transitioned to PTSB and AIB as part of the bank's sale of mortgages and loans.

C. 600 Ulster Bank employees will leave the company over the coming months after the bank opened two redundancy programmes in November.

Ulster Bank expects to open another voluntary redundancy programme in February, with further redundancy programmes later in 2023.

All current and deposit accounts with the bank have now passed their six-month notice period and are now "queued" for closure, with the exception of known vulnerable customers and customers in receipt of Social Protection payments.

The bank will commence the freezing of personal and commercial customer accounts with higher levels of activity on or after 2 February 2023. An account is frozen for a period of 30 days and unless a request is made by the customer to access the account, it is then closed.

Approximately 90% of Ulster Bank personal current accounts have either been closed or left inactive, or the level of activity has been wound down to five transactions or fewer. This increases to 94% when personal deposit accounts are included.

Ulster Bank said this trend continues to increase every day for customers approaching their six month deadline.

Furthermore, 77% of Ulster Bank business/commercial accounts have either been closed or left inactive, or the level of activity has been wound down to five transactions or fewer.

Overall, 59% of personal current accounts are already closed; and 41% of business/ commercial current accounts are closed.

Photo: The Ulster Bank branch in Ballsbridge is one of the 63 set to close on 21 April. (Pic: Leah Farrell / RollingNews.ie)