Revolut is the highest valued of the 176 'unicorns' in Europe, overtaking Swedish 'buy now, pay later' fintech Klarna, new research from BestBrokers has found.

The British-based digital bank has been valued at $45bn following a secondary sale of shares in August, while Klarna placed second on the list of European unicorns and estimated to be worth a third as much as Revolut ($14.5bn).

Celonis, a German data processing company, ranks third in Europe with a valuation of around $13bn.

Europe's unicons, ie privately-owned start-ups valued at at least $1bn based on estimates made during share sales or capital raising round, are worth a combined $503bn as of December.

A total of 1,258 start-ups analysed by BestBrokers using the CB Insights’ unicorn tracker, and most of the unicorns are based in the UK, Germany and France.

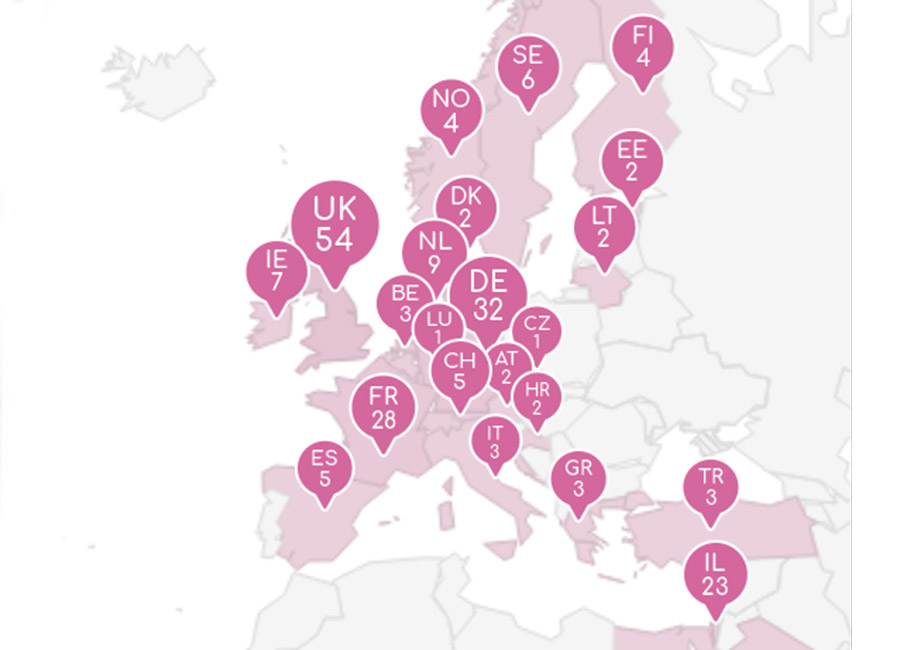

The UK accounted for 54 'unicorns' worth a total of $188bn, including 43 based in London, the most populous city for unicorns ahead of Paris (23), Berlin (18), Amsterdam (nine) and Munich (eight). Stockholm and Dublin are both home to six unicorns.

Germany has 32 unicorns ($87bn), followed by France with 28 ($70.9bn), the Netherlands with nine ($24.5bn), and Ireland with seven ($11bn).

Financial services companies dominated the top 20, with Checkout.com (5th), N26 (6th), Rapyd (8th), SumUp (10th), Blockchain.com (12th) Mollie (13th), Monzo (16th) and Mambu (20th) joining Revolut and Klarna.

Enterprise technology was represented by Global Switch (4th), Checkout.com (5th) and Personio (8th), Mistral AI (15th) and ContentSquare (19th).

Northvolt (7th) and Bolt (11th) represented industrials while Doctolib (14th) was the only life sciences company, and consumer & retail's representatives were RELEX (17th) and Back Market (18th).

Most European unicorns are within the enterprise tech sector (50 software and tech start-ups), the financial services sector (41 fintech startups, banks and payment platforms), consumer & retail sector (31 companies), and industrials (24 startups).

A total of 10 European start-ups reached unicorn status in 2024, the largest of which is French artificial intelligence company Poolside currently valued at around $3bn.

Milan-based mobile tech company Bending Spoons also became a unicorn this year and is now valued at $2.55 billion.

With a valuation of $350 billion, SpaceX is the world’s largest private company in terms of value. TikTok developer ByteDance ranks secondnd with US$220bn, followed by the company behind ChatGPT, OpenAI, which is currently valued at around US$157bn.

(Pic: Jakub Porzycki/NurPhoto via Getty Images)