Dublin e-commerce financier Wayflyer has raised $253m in debt financing from Credit Suisse, less than four months after securing $300m from JP Morgan.

The company attained unicorn status following its $150m Series B round in February led by DST Global and QED Investors that valued the unicorn at $1.6bn.

Wayflyer said the backing of the two banking giants highlighted the robustness of its business model and its position as a trusted growth partner with e-commerce businesses.

Wayflyer lends working capital to e-commerce vendors to help them stock up on inventory and invest in advertising, which is then repaid as a percentage of the merchant's daily sales revenue.

Since April 2020, it has lent some €540m to more than 1,000 businesses, using analytics to assess funding requests for applicants and providing funding within 48 hours.

The $200m debt and $53m mezzanine facility increases Wayflyer's "origination capability" as identifies and supports high-growth potential businesses with liquidity and operational resilience.

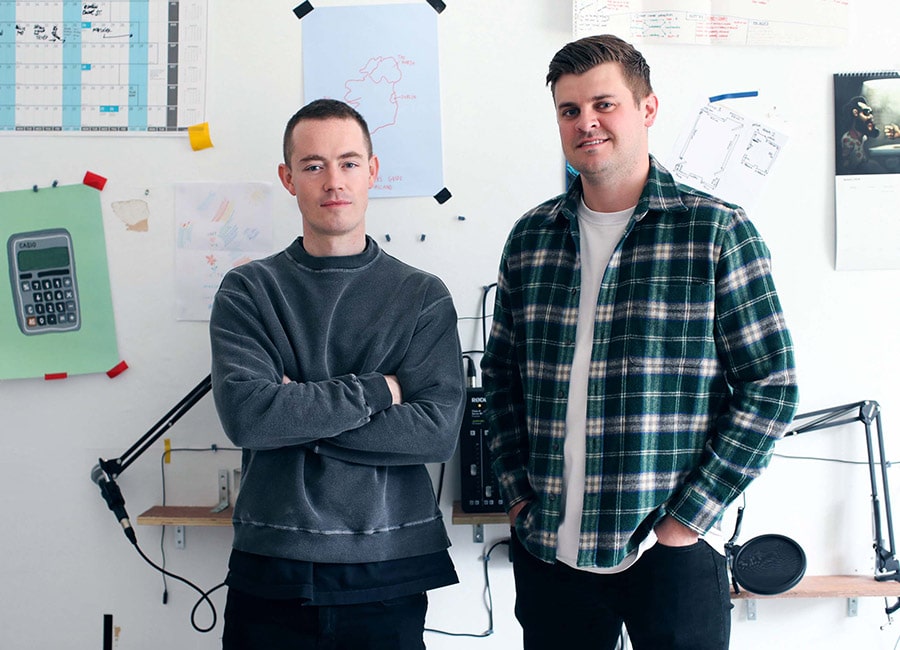

Wayflyer, founded three years ago by Aidan Corbett and Jack Pierse, said the additional debt facility would also allow it to improve liquidity and support its ambitions of offering the most competitive lending rates in the US and western Europe.

"Now, more than ever, eCommerce businesses need access to fair, flexible and affordable funding solutions from a trusted and resilient partner,” said CEO Corbett.

“At a practical level, this deal helps support our objective to offer the fairest terms and the best rates to our customers while advancing Wayflyer’s unwavering commitment to being a trusted partner, irrespective of the impact of wider economic conditions on the market.”

Wayflyer employs around 250 people in Ireland, 80 in the UK, approximately 100 at its US base in Atlanta and 25 in Australia. The company this year acquired Peblo to underpin its move into financing influencers.

Wayflyer's 2020 accounts show shareholders funds of $5.2m following a year in which it lost $3.9m.

Photo: Jack Pierse (left) and Aidan Corbett.