Sponsored Content

Don’t ignore the value of a pensions structure as part of your tax and real estate planning strategy

Many business owners accumulate wealth in their companies, hoping to sell it on and avail of the various CGT reliefs, but they may ignore the value of pensions as part of their tax and estate planning strategy. This is particularly the case when passing wealth to the next generation. With CGT rates at 33%, fund exit tax rates at 41% and marginal income tax rates above 50%, the value of accumulating wealth within a 0% tax pension structure should not be ignored.

The Power of Compounding

The power of compound interest in a 0% pension tax structure can be illustrated by the following example. Consider an individual with €250,000 in their pension fund today, saving an additional monthly contribution of €1,000 and using the 10- year Irish group average pension managed fund returns of 4.7% per annum. The results would be as follows:

• Within a pension structure:

€250,000 grows to approx. €550,000

• Outside a pension structure:

€250,000 grows to approx. €470,000

Ensuring You Maximise Your Annual Contributions

Revenue rules allow a maximum pension pot of €2m per individual, or for a couple up to €4m. The contribution amounts are generous, particularly as you get older: an individual aged 60 or over can contribute up to €46,000 p.a., with the employer contribution being up to many multiples of same.

What Happens on Retirement?

The rules can be complex but most people with the maximum pension pot of €2m opt to take a net lump sum of up to €440,000 from their pension after paying tax of €60,000. They then invest the remaining € 1.5m in an Approved Retirement Fund or ARF/AMRF.

What Happens to Funds in the ARF?

Prior to the Finance Act 2011, the individual had to purchase an annuity with the fund; if he/she died, the pension normally died with them. Now, the ARF balance can continue to grow tax-free.

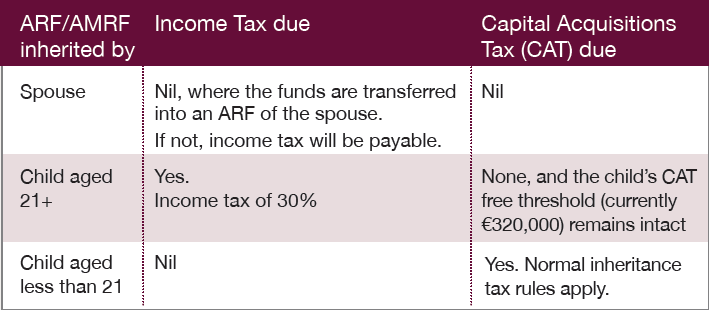

As can be seen, the ARF represents a family asset that can continue to avail of the tax-free compounding mentioned above. Upon death, it can then be passed first to the surviving spouse in a tax-effective manner and subsequently to the next generation.

Conclusion

You need to ensure that your company pension is an integral part of your tax planning strategy. Contact us for a consultation.

Tel: (091) 592 080 | Email: info@coll.ie | Web: www.coll.ie

Photo: Rory Coll, principal partner, Coll & Co