The Central Bank has released financial accounts for the first quarter up to March showing that household balance sheets have remained resilient despite the impact of the pandemic.

Household net worth reached a record high of €883bn on the back of a large increase in bank deposits and a rise in house prices and the value of insurance and pension schemes.

In addition, household liabilities fell by €1.5bn, despite a €2.5bn fall in pay compared to the first quarter of 2020.

The Central Bank attributed this position to government support schemes, which have increased social transfers to households by €3.9bn through the pandemic unemployment payment and the employment wage subsidy scheme.

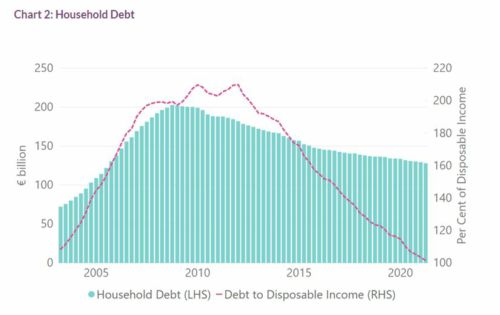

Household debt as a proportion of disposable income continued its nine-year long downward trend and now stands at 102%.

Private sector debt as a proportion of GDP rose to 231% in the first quarter, far above the 160% threshold above which the European Commission classifies the figure as a macroeconomic imbalance.

However, the Central Bank cautions that the presence of large multinationals in Ireland distorts these figures since these corporations hold significant loan and debt security obligations to their affiliates elsewhere in the world.

This makes it difficult to draw conclusions from the data about the health of the balance sheets of domestic businesses.

The presence of large multinationals also distorts Ireland's position as a net borrower or net lender to the rest of the world. While the domestic economy was a net lender in the first quarter for the first time in nine quarters, significant net borrowing during that period had been largely driven by US multinationals offloading the US treasuries they had stashed their profits in once Trump's tax cuts took effect and they repatriated their profits.

Due to the impact of government support schemes, increased health spending and falling tax revenues, government debt increased by €7.5bn during Q1 to stand at €257bn.

Despite the increase in gross debt, the government's balance sheet improved to the tune of €2.1bn as a result of revaluation of its assets