Business activity among Irish SMEs edged into negative territory for the first time since 2020 in the second quarter, according to the latest business confidence survey from Linked Finance.

In the post-pandemic era, trading was strongest in 2022 and had remained in positive territory in the subsequent three years until the most recent quarter.

However, sectors within the SME sector continue to perform well, particularly larger businesses.

The survey was conducted among 360 business owners/managers by Ipsos B&A. SMEs were classified as micro-businesses (one to three employees); medium (four to nine employees); and large (ten to 250 employees).

A third of SMEs reported that business results were worse year-on-year, an increase of two per cent from the same period last year. The increases show that several factors, both domestically and internationally, are affecting the performance of Irish businesses.

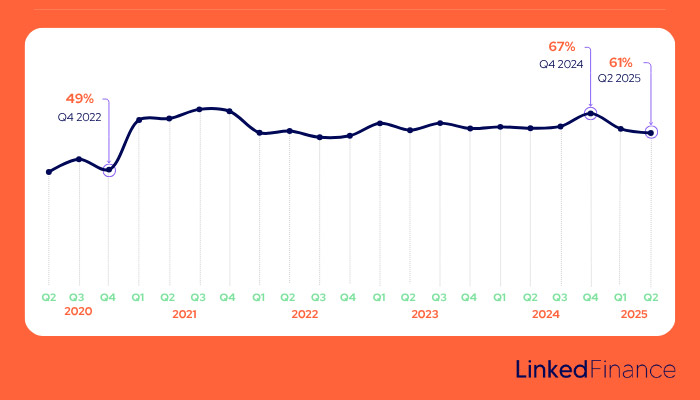

Business optimism among all Irish-based SMEs has dropped to 61 per cent from 67 per cent six months ago.

Exporter optimism in Q1 increased due to a bounce in orders rushed to warehouses ahead of threatened tariffs in the US, but has dissipated somewhat.

The retail and wholesale trade is the one area within the broader SME sector that saw increased optimism levels in the second quarter, with positive sentiment up five per cent year-on-year.

While just over two-thirds of businesses reported that their activity was in line with or higher than 12 months earlier, the survey marked the first time in five years that the tracker tipped into negative territory in terms of the gap between positive and negative sentiment (-3 per cent).

Liked Finance said that given the uncertainty in the markets and geopolitics in Q2, this still shows a good degree of resilience.

While large businesses are holding up well, medium-sized SMEs have seen the biggest change year-on-year, with almost a quarter reporting that business activity is down compared to the same period last year.

Activity levels at indigenous businesses are almost flat year-on-year, while the number of exporters who experienced a drop in trade between Q1 and Q2 2025 jumped by ten per cent due to outsized exports early in the year.

Dublin-based SMEs are performing much better than those in the regions in terms of business activity,

Firms in the capital noted an improvement in activity, with 76 per cent reporting trade levels were either stable or improving compared to 62 per cent outside Dublin.

Sentiment for the third quarter remains in negative territory at -3 per cent gap on positive over negative, again with mid-sized businesses seeing the biggest impact here.

Only a fifth expect to see a boost in business during the current quarter, compared to almost half when surveyed 12 months ago.

On the positive side, large SMEs remain optimistic for Q3, with 46 per cent expecting an upturn in business.

“We live in uncertain times, and it is not surprising that SMEs in Ireland are tempering their outlook given constant reports, and now confirmation, about tariffs. This is combined with continuing conflict in both Europe and the Middle East," said Niall O'Grady, chief executive of Linked Finance.

“However, there are several positive take-aways from the data, particularly that large companies remain bullish for the next quarter – which is important as they employ the most people here.

"In addition, micro businesses are seeing a slight improvement while the retail and wholesale trade is showing some green shoots.”

SMEs were asked how concerned they are about the possible impacts of a global trade war based on the US’s campaign of trade tariffs.

Overall, almost a quarter were not concerned about this. However, in terms of larger SMEs as a sub-group, 54 per cent said that they were concerned this would have either a slight or a large impact on their business.

A third of medium-sized firms believed it would have a slight impact.

“While the recent announcement of 15 per cent tariffs for many EU goods is not a welcome one, there is a bigger picture to consider,” according to O’Grady.

“Many SMEs in Ireland provide services – and this sector continues to thrive – and is exempt from tariffs. We now have a stronger level of certainty about where things are at, which enables businesses to progress with investment.

"SMEs are now accustomed to ongoing challenges in the last five years, and I have no doubt that we will see more growth and optimism as the year goes on.”

More than 50 per cent of SMEs have held their prices over the past year, and five per cent have reported price cuts, while 40 per cent have increased their prices.

In the two years from Q2 2023 to Q2 2025, the share of SMEs charging higher prices has dropped ten percentage points from 52 per cent to 42 per cent as inflation has eased.

Smaller SME businesses are more likely to be charging the same prices, while Dublin based businesses are more likely to be lowering prices (eight per cent) compared to half that number (four per cent) outside the capital.

Overall, prices are plateauing this year to date.

While SMEs surveyed are still feeling the squeeze when it comes to profitability - with 32 per cent reporting a drop in profit year-on-year - a growing number (44 per cent) said that operational profit is the same.

Micro businesses are stabilising somewhat, with almost half the same profit year-on-year, with mid-sized businesses just tipping into negative territory in Q2.

Employment levels have increased marginally year-on-year, but ten per cent of businesses have reduced their headcount over the past 12 months.

Some 36 per cent of large businesses reported higher employee numbers, but only a tenth of businesses outside Dublin have added staff.

Photo: Niall O'Grady. (Pic: Paul Sherwood/Coalesce)